Vietnam: Strategic Sourcing destination for Machinery & Equipment

Vietnam: Strategic Sourcing destination for Machinery & Equipment Read More »

Strategic Sourcing plans should consider the opportunities offered by Turkey. As Sourcing and Procurement teams explore opportunities to shorten supply chains, look for alternative suppliers or find new fast growing potential markets to work with Turkey should be part of their thinking.

Many companies are already seeing the positive benefits Turkey can offer them as Turkey’s exports gain pace. Turkish Export growth has seen three consecutive months of year on year growth. As demand and supply sides build to support deliver to challenges fuelled by

What can Turkey offer Sourcing and Procurement teams ? Why should it be considered as a core part of any Global Sourcing Strategy.

Turkey as a strategic sourcing destination can deliver a range of structural and economic benefits making doing business smooth and seamless.

5. Trade agreements: Turkey has trade agreements with many countries, including the European Union, making it easier for buyers to source products and conduct business with Turkish manufacturers.

6. Ease of doing business: Turkey has made significant improvements in its business environment in recent years, including streamlining bureaucracy, reducing regulations, and improving the ease of doing business.

Turkey has a diverse range of exports but some of its biggest exports include:

1. Automotive parts: Turkey is a major producer of automotive parts, with exports worth over $20 billion in 2020. The country is home to several large automotive manufacturers and suppliers, and its high-quality parts are in demand worldwide.

2. Textiles: Turkey is one of the world’s leading textile producers and exporters, with exports worth over $10 billion in 2020. The country is known for its high-quality cotton and textile products, including clothing, fabrics, and home textiles.

3. Machinery: Turkey is a significant exporter of machinery and equipment, with exports worth over $9 billion in 2020. The country produces a range of machinery, including industrial equipment, agricultural machinery, and construction machinery.

4. Chemicals: Turkey is a major producer of chemicals, including petrochemicals, plastics, and pharmaceuticals, with exports worth over $8 billion in 2020. The country’s chemical industry is well-established and highly competitive.

5. Food products: Turkey is a major producer and exporter of food products, including fruits, vegetables, nuts, and processed foods. Exports of food products were worth over $7 billion in 2020.

Turkey’s biggest exports reflect the country’s diverse economy and its strengths in manufacturing, textiles, and agriculture. Alongside their traditional market strengths Turkey is fast building strong positions in several other markets.

1. Defense industry products: Turkey has seen significant growth in its defense industry exports, particularly in the Middle East and North Africa regions. The country’s defense exports have grown by over 20% annually in recent years, with total exports reaching $3.2 billion in 2020.

2. Electrical machinery and equipment: Turkey has seen strong growth in its exports of electrical machinery and equipment, which have grown by over 10% annually in recent years. Total exports in this category were worth $18 billion in 2020.

3. Medical devices: Turkey’s exports of medical devices have grown rapidly in recent years, driven by the country’s strong healthcare industry and growing demand for healthcare products. Exports of medical devices were worth $2.8 billion in 2020.

4. Iron and steel: Turkey is a major producer of iron and steel, and its exports in this category have grown by over 10% annually in recent years. Total exports of iron and steel were worth $14 billion in 2020.

5. Plastics: Turkey’s exports of plastics have also seen strong growth in recent years, driven by demand from Europe and the Middle East. Exports of plastics were worth $5.6 billion in 2020.

ET2C Is a global sourcing company with over twenty years’ experience working with our clients to deliver their Sourcing Strategies. Our offices in seven countries, including Izmir Turkey, ensure you always have a team on the ground to be your bridge to your Offshore suppliers.

Giving you independent feet on the ground and confidence with fast responses, removing time zone and language challenges.

If you would like to explore sourcing opportunities within Turkey or to discuss your future supply chain challenges.

Please contact us at contact@et2cint.com

Turkey: A Powerful Export Market for Global Sourcing and Strategic Sourcing plans Read More »

Strategic Sourcing from India, the high growth economy that should be in your Global Strategic Sourcing plan

With a population of over 1.2 billion, India is the World’s largest democracy, the second most populated country on the planet. It now boosts the World’s 5th Largest Economy WEF

Over the past decade, India’s integration into the Global Economy has been accompanied by similar levels of economic growth. Leading India to emerge as a Global Economic player and a country capable of playing a significant role in any product Sourcing Strategy.

“We believe India is set to surpass Japan and Germany to become the world’s third-largest economy by 2027 and will have the third-largest stock market by the end of this decade,” says Ridham Desai, Morgan Stanley’s Chief Equity

Building on their unique set of competitive advantages provided by:

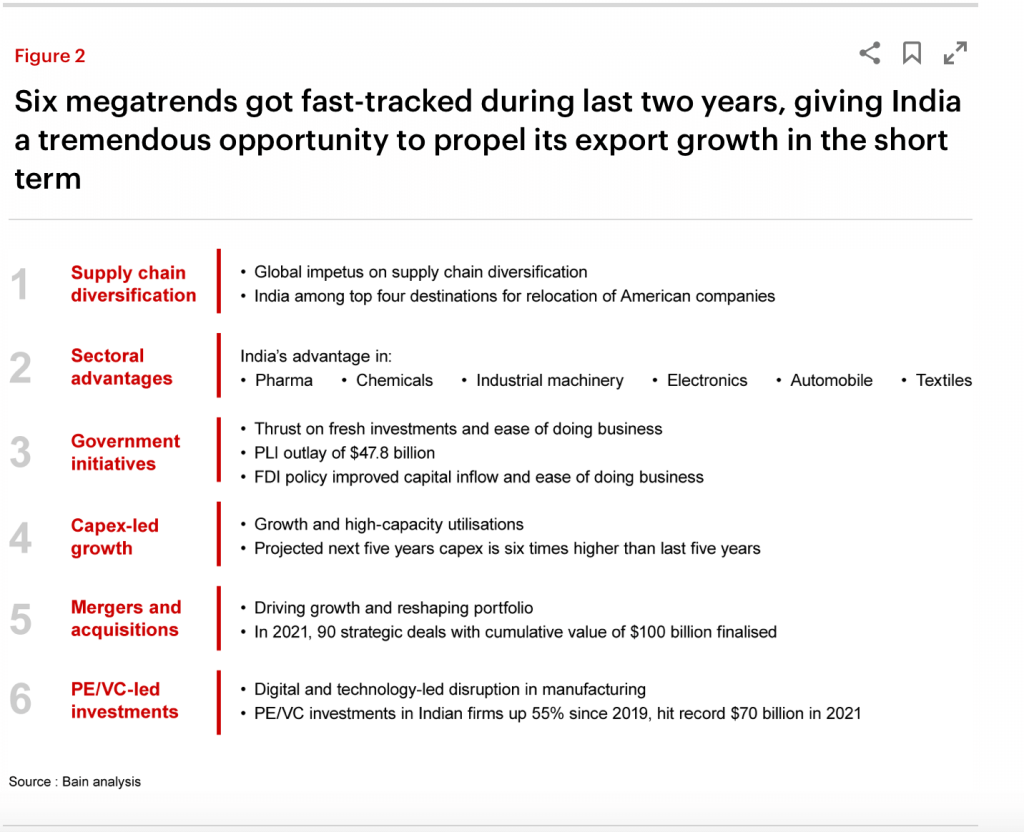

The Regulatory environment has fuelled the delivery of six mega trends

1.Supply chain diversification

Fuelled by the global turmoil and moves by many companies to find alternative or additional sourcing partners to supplement China. India has benefitted from many companies in USA and Japan relocating supply chain partners to build future shock resilience.

Industrial components

Textiles

Electronics and EV technology

Manufacturing competitiveness in India has benefitted hugely from skilled work force and lower labour costs allowing highly competitive pricing position v other markets. India steel manufacturing also fuels the competitiveness of the manufacturing sector. The textiles & Apparel markets in addition to the cost and quality of labour India has easy access to high quality raw materials.

EV manufacturing and innovation and India’s ambition to be a Global Hub for EV industry and Technology. India will launch 40 models of EV car models from a range of Car brands. Support for the industry has been further supported by the recently announced the opening of the worlds largest EV hub supporting the manufacture of both vehicles and advanced cells.

3.Government initiatives

The Indian Government continues to strive to create the rights conditions for Export business to flourish. Foreign and domestic investment in manufacturing has increased supporting further output growth.

4.Capex

As many factories reach high levels of utilisation, benefitting from the strong growth in the Indian economy. Investment levels are rising rapidly both from Government and Private enterprise.

5.M&A

Manufacturing companies are using M&A as a way of building scale and adding capabilities to their portfolios and export capability. Deals were $108b in India in 2021 of which 16% were in the Manufacturing sector.

6.PE/VC funding

In the last few year significant investment has flown in India industrial and export sectors. Fuelling growth in the start up Eco System and building transformative growth. The Manufacturing sector benefitted from over 16% of this investment.

Summary Indian Export growth

Indian continues to build its position as a global export powerhouse. Strong infrastructure in pace, continued investment and Government commitment to creating to export growth helps to make India an easy country to do business in.

It has the second largest railway network in the world and a vast coastline with established seaports.

Strategically located nearly 10,000 KM closer to Europe and the USA.

For companies wrestling with the need to evolve their Sourcing Strategies. Starting to look at Off Shoring options or as part of a wider China +1 strategy India should be top of your list of countries to investigate.

Key export areas of

Industrial Components.

Textiles

Electronics particularly EV Technology

Can provide exceptionally high value and innovative products whilst retaining a lower-cost base.

ET2C Is a global sourcing company with over twenty years’ experience working with our clients to deliver their Sourcing Strategies. Our offices in seven countries ensure you always have a team on the ground to be your bridge to your Offshore suppliers. Giving you independent feet on the ground and confidence with fast responses, removing time zone and language challenges.

If you would like to explore sourcing opportunities within India or to discuss your future supply chain challenges.

Please contact us at contact@et2cint.com

Strategic Sourcing from India – The Growing Economic Powerhouse Read More »

Global Sourcing and Procurement functions are taking on a new enhanced mission within business. The immediate impact of which is to dramatically broaden their focus and accountabilities.

This fast rate of adaption and development of new responsibilities and challenges creates a need for New Skillsets, Data and Inputs.

For many teams who sit outside Global organisations this requires the rapid building of a New Eco System of partners to support the rapid delivery of new responsibilities. Building both the structure and systems to manage data but also the insight and decision-making skills required for analysis and action planning.

What some of the pressing agenda points for Chief Procurement Officers and Global Sourcing teams?

How can they keep on top of these big challenges as they rapidly evolve?

These 7 topic areas are increasingly important for companies and brands of all sizes to understand and review as part of their Global Sourcing Strategy. For many already stretched teams the need for skilled Partners to support their delivery of answer to these questions is crucial.

https://et2c.com/corporate-profile/

5 reasons your business will benefit from a well-developed and executed Global Sourcing Strategy.

As the Canton fair opens for the 133rd time, bringing together business from across the globe. There is no better time to review and reflect on the need for a strong Global Sourcing strategy.As Sourcing and Procurement teams manage enhanced missions and a more elevated seat at the corporate table. Refining and delivering the Sourcing Strategy is even more important for corporate success.

Overall, a well-designed and executed strategic sourcing plan can help your company reduce costs, improve supplier relationships, increase efficiency, mitigate risk, and align procurement decisions with broader business goals.

Why you need a strong Global Sourcing Strategy for your business ? Read More »

Near Shoring Challenges as Globalised Trade Continues to Grow

The immediate rush and to change Sourcing Strategies, shorten supply routes and ‘Near Shore” is proving much tougher to achieve than anticipated for Sourcing

After the effects of the Global Pandemic, Ukraine War, US-China Trade conflicts and Inflationary pressures to name a few. There was a lot of talk about the need to shorten supply routes and Near or at least friendly shore sourcing.

The background to the rush to Near or Friendly shoring has been the nearly five years of open economic conflict between the US and China. US-China trade flows hit an all-time record of $690.6 billion in 2022. Connecting the countries by a larger movement of trade than any other Nations (without shared borders).

Suggesting that Globalisation is not showing signs of halting. DHL in their recent report suggest that the US-China trade relationship is beginning to show a “general pattern” of decoupling even as globalization more broadly remains resilient, according to DHL’s global connectedness index.

“International flows have proven remarkably resilient through recent crises, and they strongly rebut the notion that globalization has given way to deglobalization,” according to the report, produced with New York University’s Stern School of Business.

“Today’s threats to globalization, nonetheless, are real and demand serious attention,” it continued. “It would be a mistake to infer from the recent resilience of international flows that globalization cannot go into reverse.” What has been the real world experience of brands and companies looking to Near Shore as part of their Sourcing Strategy ?

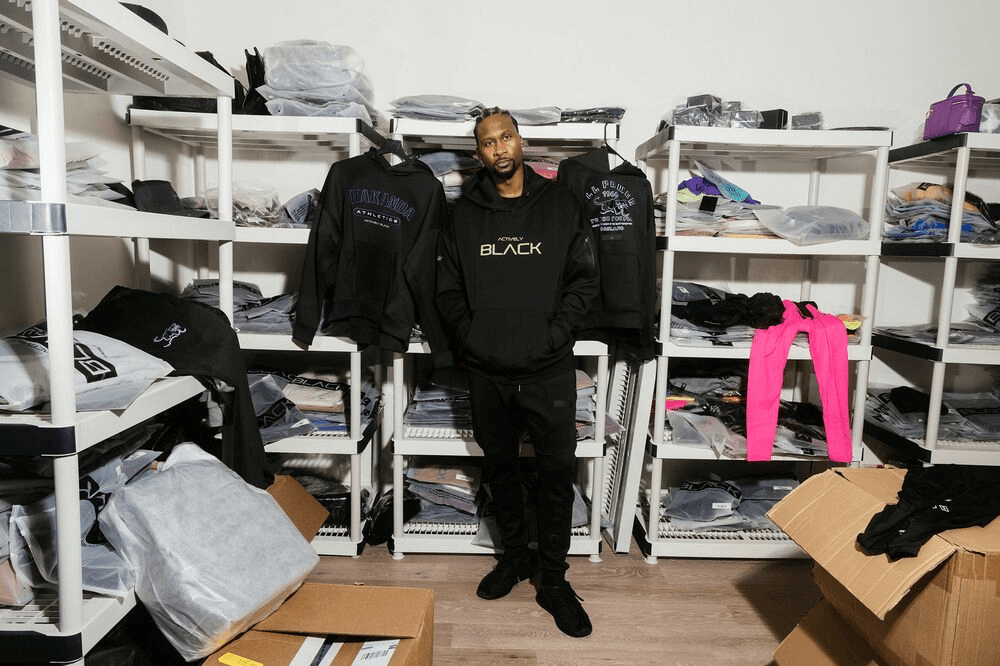

US Apparel Companies Can’t See a Future Without China

Brands are finding few factories outside the country that can produce the quality and quantity they require.

When Lanny Smith founded Actively Black Inc. in 2020, he hired factories in China to produce the brand’s athletic wear. But last year, concerned about production delays caused by China’s Covid lockdowns, Smith explored buying elsewhere. He shipped samples to a supply chain agent who’d assured him there were alternatives in Latin America. “He hit me back the next day and said, ‘You’re not going to find anybody who can do this in the Western Hemisphere,’” says Smith, 38, a former basketball star at the University of Houston.

For many companies buying from China has become more challenging in recent years because of increased tariffs, snarled supply chains, factory shutdowns under Beijing’s Covid Zero policy and rising geopolitical tensions. Factors which have combined to make many Companies and brand owners investigate changing their Sourcing Strategy to be China +1 or to seek to replace China completely. Whilst on the face of it the idea has a lot of merit and upside finding suppliers who can match China for quality and price is not so simple.

Quitting China as a sourcing partner isn’t easy, and most progress has been concentrated in industries such as semiconductors that are considered vital to national security or have high added value. Producers of lower- tech, lower-margin and less added value products such as clothing, shoes, housewares and luggage are finding that few factories outside China have the machinery or the skilled workforce to deliver the quality and specifications required.

Since the 1990s, China has spent hundreds of billions of dollars transforming itself into the world’s premier location for manufacturing. Its factories have the machinery and expertise needed to produce quality products at a volume and pace that’s difficult to match. Along the 80-mile stretch from Shenzhen to Guangzhou, companies can weave, dye, sew, trim, label and package anything from T-shirts to tuxedos. And China’s investment in highways, railroads, air hubs and seaports has created a smooth path from factory gate to consumers worldwide.

Twenty years of Global Trading growth between China and the World is not something that can be dismantled quickly and easily. China’s advantages as a sourcing destination are so great that many companies that have tried to move away have returned at least a portion of their production there. Even moving away from the Chinese mainland cannot guarantee moving away from China. As China has expanded its influence, support for infrastructure and factory investment to other countries such as Ethiopia.

When companies move manufacturing out of China, they often end up working with Chinese- owned suppliers or sourcing components and materials from the country.

Summary

Sourcing strategies are not always quick and easy to implement, the initial idea to relocate manufacturing from China to other Asian or African markets can suggest instant benefits. China’s experience of supplying and shipping products around the World is difficult to replicate. For some markets this may well require more product side compromises to deliver the geographic move.

ET2C Is a global sourcing company with over twenty years’ experience working with our clients to deliver their sourcing strategies. Our offices in seven countries ensure you always have a team on the ground to be your bridge to your Off Shore suppliers.

If you would like to explore Sourcing Strategy options or opportunities within China or in addition to China or to discuss your future challenges.

Please contact us at contact@et2cint.com

Is Near Shoring still a good option for Sourcing Strategies as Globalised Trade Grows Read More »

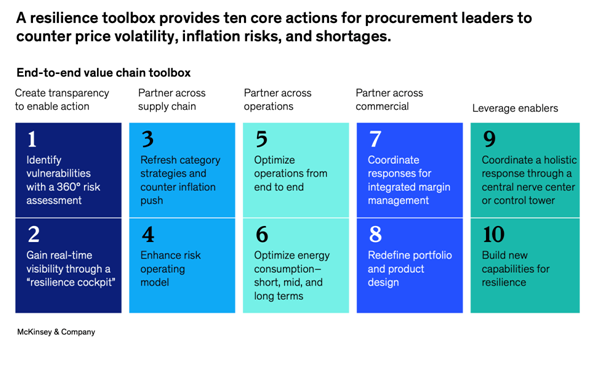

Global Sourcing 2.0 will define the response of Procurement and Sourcing Teams to another year of volatility. Inflationary pressure continues to build and the business need for Environmental and Supply Chain Risk management gains momentum, creating huge challenges for Sourcing and Procurement Teams.

Procurement and Sourcing Team leaders who had hoped that economic conditions in 2023 would make their jobs easier than last year are already disappointed. As the new year began, the volatility and inflation of the previous year showed no signs of abating

Many of the dimensions of change impacting business in 2023 are likely to still be with us in some form at the outturn of the year. Procurement and Sourcing functions are responding to these wide-ranging challenges in an equally wide range of structural changes and ways of working adaptations. Sourcing teams are facing the New Challenge of Global Sourcing 2.0

Macroeconomic conditions straining procurement

Understandably, the aggregate effect of these challenges has overwhelmed many procurement functions. Procurement can play a critical role in solving today’s most pressing business problems, but it cannot do so on its own. Winning now requires an entirely new level of resilience improvement and value creation built through a coordinated enterprise-wide effort. Global Sourcing in 2023 requires Procurement teams to sit at the heart of business in an expanded mission.

-Protecting against Corporate margin erosion

-Deliver on Environmental and Social Risk in Supply Chain

-Build Resilience against the next Black Swan event

Accordingly, success in protecting margins, containing cost escalation, and dynamically capturing opportunities requires an expanded mission for the procurement function. CEOs should consider positioning their procurement leaders at the center of the company’s response to the current context, tasked with a clear mandate to protect margins. CPOs can then mobilize executives for cross-functional impact and escalate investments in the talent and systems required to achieve and sustain outperformance.

Visibility-Measurement-Action-Reduction

Procurement leaders can combat volatility, inflation, and shortages and build resilience by taking ten core actions. The first critical element required is to gain transparency over the pressures and change drivers in their supply chain. Only be creating true visibility can they start to identify the key decisions required to deliver high level objectives. This will require

support from all functions across the business and external partners to support Procurement in developing a more agile approach.

Wide ranging Risk Assessment of Supplier Network

· Suppliers. What vulnerabilities—including financial, fulfilment, reputational, and environmental—do suppliers face?

· Supply. How are events affecting the end-to-end value chain? Which categories may be hard to secure in the foreseeable future?

· Cost. How are suppliers’ costs of goods sold (COGS) trending? Can we quantify the inflation or deflation they face? What do the results mean for our company’s P&L?

· Environmental. How are Key Suppliers measuring their Environmental impact and taking active measurable and visible steps to reduce as part of wider range of commitments

· Social, How is the Supply network mapped Globally against potential Social risks and are key suppliers.

Building New Skill Sets to Deliver an Expanded Mission for Procurement

As Procurement leaders wrestle with the new challenges of Global Sourcing 2.0 the need for a new range of additional skills becomes a critical need for delivery.

As Sourcing and Procurement teams play a more central role in business delivering their expanded contribution. The need to rapidly build skills will become a critical enabler to deliver their New Mission.

· Delivering a visible assessment of high level risk, across the entire supply chain

· Identifying Environmental impacts, particularly Emissions generated within Supply base

· Minimising impact on Key suppliers at potential risk of audit fatigue

· Building working Partnerships

Global Sourcing 2.0 represents a shift in priority and ways of working. From the old Procurement model of expecting Suppliers to make and supply to a forecast and at the cheapest possible price.

To one where there is a more collaborative approach to Sourcing Strategy based on visible shared data, shared Environmental and Social

commitments and strong partnership for growth. A shared vision of the future that can inform the future requirements.

We have long argued that an approach based on strong partnerships is a more successful Sourcing model than the focus on Cost and make to Forecast.

Summary

As more companies move to re structure the breadth of the Sourcing team mission within companies core competencies and skill sets need to be created, adopted and utilised.

Sourcing teams will need to rapidly build or bring in the skills required to bring full risk and impact visibility to their supply chain.

ET2C are a leading global sourcing company, with over twenty years’ experience supporting our clients to develop and deliver their sourcing strategies. We have seen a big rise in our clients demands for

-Emissions measurement and management

-Risk identification

-Quality and Compliance. Social & ethical Auditing

As many companies move rapidly towards a future defined by Global Sourcing 2.0. Drop us a line to see how we could support you in your challenges

Email us at Contact@et2cint.com.

Challenges for Sourcing Strategies-Global Sourcing 2.0 Read More »

The 133rd Canton Fair will open in April as China Factory output accelerates, supporting an upturn in China Sourcing but does demand remain subdued?

Dogged for months by shortages of raw materials, labour instability, a difficult Covid policy, quickening inflation and weakened consumer demand, the world’s industrial engine is still struggling to fire on all cylinders. For many weeks, anticipation has been running hot that China’s reopening would bring a tangible economic lift across Asia and perhaps the rest of the world. That day seems to have finally arrived, with purchasing managers’ indices — especially from China, but also beyond — showing the first glimpses that the World’s second-largest economy will start to lift orders in other corners of the globe.

The Canton Fair comes at a time when China is reopening to the West post Covid and notably a combination of raw material price softening and low container rates, put the spotlight back on ‘cost’ for buyers where this is now their sole focus in the short to medium term. The biennial trade fair is one of the high points of global trade events and is expected to welcome over 25,000 exhibitors and buyers from all over the world.

Is Demand Picking Up?

Although there is an expectation that this Canton Fair will be large (Buyers and importers will no doubt be chomping at the bit to get out and see some product rather than at a distance!), what are the factors that will dictate the appetite to get out on that plane?

1.Consumer Confidence , as a general trend, has certainly softened across many markets due to inflationary pressures which have hit discretionary spend. Every market has its own domestic economics that need to be assessed. There is however data coming out that points to a less bleak outlook than initially expected (UK is not likely to be in a recession in 2023 as initially thought) and this could lead to a pick-up in confidence going deeper into the year.

Shipping

rates have dropped to Pre Pandemic levels. A year ago container ships were queuing for births in ports to unload their cargoes, shippers were bumping containers and contract rates were not worth the paper they were written on. Container rates were at an all-time high and shipping companies took full advantage of the market impact (note the amount of blank shippings to prop up the market). A year on ships are being moth balled and sailings cancelled as demand has plummeted and spots rates dropped to Pre pandemic levels. The recent conference in the USA Davos by the Sea brought into clear focus the strained relationships and tensions between shippers and shipping line owners.

Inflationary cost

pressures on Brands, Retailers, Wholesalers and Importers. Pressure on cost has returned in many companies to counter inflationary pressures forcing prices up in front of the consumer. As we lived through the turmoil of the pandemic, the overriding issues for supply chain teams was to get product on shelf. As demand softens and inflationary cost pressures build in companies the focus for sourcing teams has shifted back to a focus on cost. Will China be a main beneficiary of this?

The Reopening of China

Has been rapid, and appears to be have weathered any Covid storm (we did not see any interruptions to factories even post CNY). It is seen as a potential catalyst to energise economies across Asia and the wider world back into growth. China factory output has expanded at the fastest pace in more than a decade. The sudden access to this market could not come any sooner.

Inventory Levels

Are still high across some sectors. This is impacting buying decisions as companies look to manage higher stock levels due to large buys in 2021/22 and weaker demand. It is key that this stock is sold through to set companies up for the remainder of the year.

Summary

The Canton Fair appears to be aligned to the reopening of China, and the expectation has to be that many people are anticipating travelling out to Guangzhou and further afield within China to see suppliers for the first time in 3 years.

The need to drive cost benefit to the bottom line is supported by vastly reduced shipping costs compared with the past 18 months and China is still well placed to off cost advantages. The Year of the Rabbit may just be as prosperous and lucky as intended!

For more information on the Canton Fair, China and other sourcing markets please drop us a line at contact@et2cint.com.

Canton Fair: A Tipping Point for Global Sourcing? Read More »

Textile and Garment Industry Growing Sourcing in Ethiopia

Ethiopia’s sourcing opportunities for companies in the textiles and garments industry have been steadily growing, reaching $171m in exports, but it has taken a major hit from the onset of the pandemic followed by the Tigray civil war in the north. Will it be able to weave its way back to its former glory?

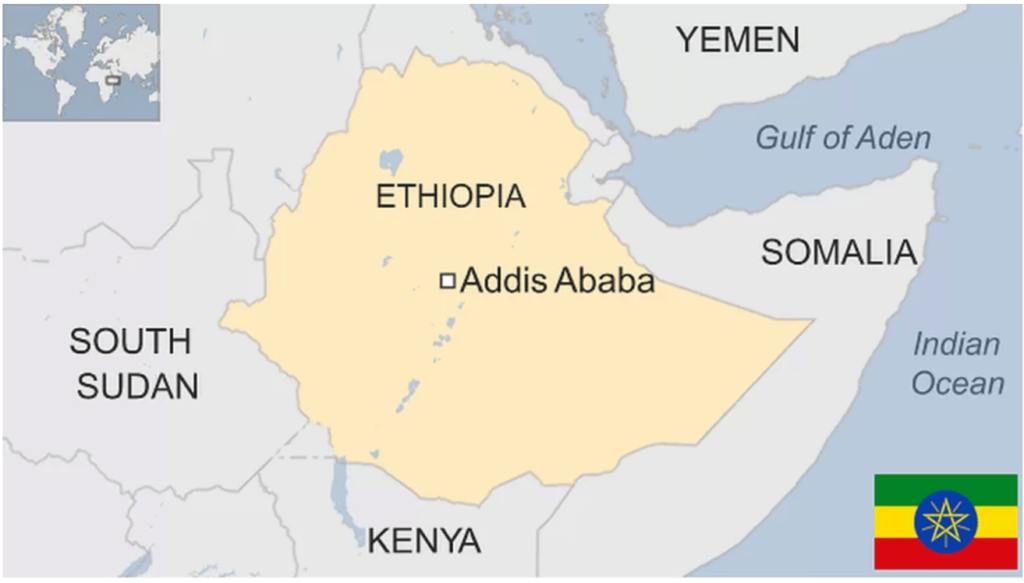

Located in the Horn of Africa, landlocked bordered by five countries and split by the huge Rift Valley. Ethiopia is Africa’s oldest independent country, a founder member of the United Nations and the has the second-largest population (after Nigeria) of over 122m people

Ethiopia is still the fastest growing economy in the region, with 6.3% growth in FY2020/21. Over the past 15 years Ethiopia’s economy has been one of the fastest growing in the World averaging over 9%.

Exports dropped to $140m in the first year of the pandemic alongside the start of fighting in the Tigray region in 2020. However, the biggest blow came from US-imposed sanctions in January 2022. Ending Ethiopia’s preferential market access under the Africa Growth and Opportunity Act (AGOA) has deprived the industry of its biggest client (80% of textile exports).

Industrialisation and free trade

Few countries in Africa have been bolder and more focused in recent years than Ethiopia. The origins of this orientation towards Industrialisation can be traced to the country’s Agriculture Development-Led Industrialisation (ADLI) strategy, which was developed in the mid-1990s. Its aim was to enable Ethiopia to make initial gains in industrialisation through robust agricultural growth and linkages between the agriculture and industrial sectors.

The Ethiopian government heavily invested in transitioning from an agriculture-based economy to an industrialised one to attract the private sector.

“We initially produced plastic shoes in 1993 but switched to textile in 2008 and expanded to garments in 2012. The plastic industry was saturated, [so] government incentives encouraged investment in horticulture and textile,” Eyob Bekele, Desta Garment’s general manager, tells The Africa Report.

Ethiopia has more than 65 international investment projects under its name. The Ethiopian government has initiated several design incentives to accelerate this sector. It is proving to be a boon for the apparel marketers.

Textile Production in Ethiopia

Ethiopia has a long history of textile production. Nowadays, it is a booming sector for marketers to conduct sourcing activities in Ethiopia. A range of factors contribute to Ethiopias success as a centre for textile production

Various factors made this country a prime apparel sourcing destination. This country has a wide availability of raw materials under its name. This easy access to resources is intriguing modern-day apparel marketers at large.

In the last 6 years, the textile and apparel industry of Ethiopia has shown huge progress. This recent surge in the apparel production made Ethiopia a prime garment exporter to the foreign markets. It is indeed promising for brands, retailers, and suppliers.

Ethiopia is very likely to become a middle-income country by the end of 2025. Delivering on a key objective of the Ethiopian government.

The government of this country is taking every step to make the apparel sector more globally competitive.

The Ethiopian government is addressing the necessary structural reforms to reshape the country’s economy. Their ambition is to create thousands of jobs while attracting foreign currencies at large. The long term goal being to reduce the poverty of the country.

The Growth and Transformation Plan 1 and 2 outline a plan to create 15 export-geared, world-class, and eco-friendly industrial parks. All these parks should have a well-built infrastructure, safety options, and low carbon emissions. Many parks also enjoy Government facilities on site to support Banking, Import and Export licenses and Customs Clearance.

Chinese Investment in Ethiopian Development

China has invested heavily in Ethiopia alongside five other resource-rich countries – Nigeria, South Africa, Kenya, Ghana, and Tanzania. China supports Ethiopia in playing a greater role in international and regional affairs and stands ready to communicate and cooperate with Ethiopia. Support includes building the Addis Ababa-Djibouti electrified railway, also known as the Ethiopia-Djibouti railway, the first trans-boundary railway on the African continent.

These deep ties have helped develop Ethiopia’s infrastructure to be able to support economic growth and have seen significant investment by Chinese companies. Currently, there are about 400 Chinese construction and manufacturing projects in Ethiopia, valued at over $4 billion.

Ethiopian has a large population and skilled workforce who provide a relatively inexpensive labour force

Ethiopia’s location on the Gulf of Aden allows fast access to Northern European ports. Reducing potential transit from Asia by over 11,000 Km.

Djibouti to Rotterdam 8,577 km

Shanghai to Rotterdam 19,600 km

Ethiopia has invested in road and rail. Particularly the rail link to the neighbouring country Djibouti which provides deep water sea port access to Europe and North America.

Ethiopia enjoys duty free market access to both the EU and USA under the terms of the African Growth and Opportunity Act (AGOA) EU Africa trade

Ethiopia is a cotton growing Nation with access to large amounts of additional cultivatable land. Climatic conditions are ideal for cotton development and there is good access to Hydro-energy for factories.

Summary

Ethiopia should be a destination on every Sourcing Teams list for review as an apparel or textiles supplier. As a strategically well-placed country, with both a strong agricultural sector, freed trade agreements and good infrastructure links. It should be a country on every

ET2C Is a global sourcing company with over twenty years’ experience working with our clients to deliver their Sourcing Strategies. Our offices in seven countries ensure you always have a team on the ground to be your bridge to your Offshore suppliers.

If you would like to explore sourcing opportunities within Ethiopia or to discuss your future supply chain challenges.

Please contact us at contact@et2cint.com

Ethiopia-Sourcing Opportunities for Textile and Garment Industry Read More »