Entering New Asian Sourcing Markets

While upsetting the start of 2020, the coronavirus has highlighted the importance of having a diversified sourcing strategy. It is true that many companies were already casting their net outside of China to identify suitable suppliers as part of a broader strategy to ‘de-risk their supply chains’. Most recently, US businesses have found themselves looking for other sourcing jurisdictions as a means of mitigating the penal tariffs imposed by the Trump administration in 2019. Although these have now abated as part of the ‘Phase One’ deal, certain categories are still subject to additional tariffs and where this is not the case, US companies have taken the hint to look beyond China for some of the product ranges. Asian sourcing is now integral to buying from this part of the world.

Asian Sourcing Markets.

China, with its scale, will remain an important part of any sourcing strategy but it is likely that a ‘China plus’ (China plus one other jurisdiction) or ‘China plus plus’ (China plus more than one other sourcing jurisdiction).will be the strategy of choice for companies leveraging the benefits from the Asian sourcing sector for the foreseeable future. Over the past decade, alongside China, Asian nations with an abundance of low-cost labour have looked to export manufacturing as a means of growing their economies and creating wealth for their workers. Vietnam, Bangladesh, India, Indonesia, Cambodia, Laos and to a less extent Thailand can all be added to this list.

We have therefore been speaking to our teams based around Asia, to gather some insight into what considerations companies should review when entering new markets and engaging with new suppliers. It is certainly true that the Chinese manufacturing base has, over the last 15 years, developed an understanding of what it means to export goods to certain markets and have been able to tailor their services to align, in some cases seamlessly to their clients’ needs.

Insight

Our perspective comes mainly from a Vietnam/India sourcing context but does take into account other markets across the region. We have also looked to identify points that are common to most Asian markets rather than list market specific issues. These are as follows:

1.Do not underestimate culture & language.

Dealing with a Chinese supplier is wholly different from dealing with an Indian or a Vietnamese supplier. Whether it is an interpretation of an email, timelines, quality-assurance standards etc., make sure you are clear in communication and be rigorous in validating any information provided.

2.Cost should not be King.

Cost is germane to any purchasing decision and margin is often still the main metric that buyers are judged against. Often to make Asian sourcing work and new suppliers to be onboarded, a longer-term view needs to be adopted. This may mean entering into a trial phase to understand the factory’s capability under production conditions. It may mean that the cost is similar or even higher than the price point of your incumbent supplier. Possibly, see if you can get a Bill of Materials(cost breakdown) to further understand any cost drivers and/or anomalies.

3.Understand the complete supply chain.

China’s manufacturing sector is vast compared with some of its Asian neighbours. There are still some 300 million migrant workers in China. You look at Vietnam as the ‘workshop’ of the World and the total population is only 97 million. The point being that with scale comes the large supplier network, infrastructure, market competition and raw material availability. Therefore, you should understand the different aspects of the supply chain. Is the raw material locally sourced or from overseas? What does the labour pool look like? What are the cost implications of this? Are there additional lead times? There may be manufacturing limitations in a particular market; for example, the cost of a PU finish on metal worked products in Vietnam is expensive. Ultimately, this will all play into the commercial opportunity. It is important to do your due diligence.

4.Over-manage production & quality.

As with any new production, it is important to over-manage the production process and quality piece to ensure you are getting the visibility you need. Keep people on the ground to monitor the production and conduct the inspections as the products come off the line. That visibility is key.

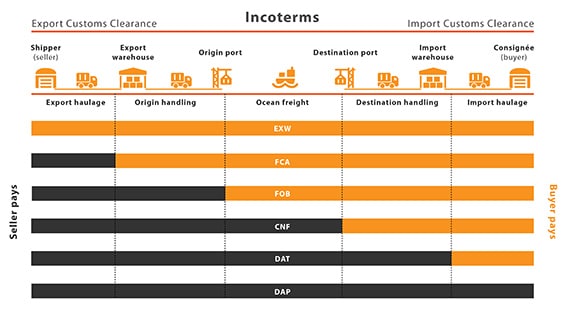

5.Logistics.

Although there has been a significant uptick in investment in had infrastructure across the Asian region, make sure you understand which ports your products would be shipped to, how they get there and any possible bottlenecks. For example, certain ports may only have one shipment per week to your local market.

6.Be patient.

Do not expect the same type of relationship and information flow compared with factories that already know how you operate. There is likely going to be a learning curve as the supplier develops an understanding of your product. In some cases, you may not get to the price points you require initially, but, as above, this needs to be looked at over a medium-term horizon to develop viable suppliers in alternative markets.

Summary

There is no doubt that a broad Asian sourcing strategy will help mitigate risk and provide opportunities across the region. Entering new markets does come with challenges but as long as this is done correctly, then there are considerable benefits to your business.

At ET2C, we are well placed to help manage your China suppliers but also help you penetrate new sourcing markets and leverage the benefits using our on the ground expertise. Should have any queries on Asia sourcing, or more specifically Vietnam sourcing and India sourcing, please contact us at contact@et2cint.com.