As the bell rings to mark the end of the 2nd round of the bout between the United States and China, there are still no real insights into the fighters’ respective strategies nor which is going to be able to outmaneuver the other. The crowd is understandably nervous about the reverberations of both the fight and the outcome and its impact upon them.Talks concerning the trade pact ended in 2015, but according to Vietnam’s Minister of Industry Tran Tuan Anh, it took longer than normal to finalize the specifics of the deal because the European Court of Justice wanted to ensure investment protection by enacting a separate Investment Protection Agreement (IPA).

Statistics

China, with its 1.34 billion people versus the United States’ meager 311 million people, remains the underdog because of the relative size of economies and trade deficit. In 2017, the GDP of the USA was $19.4 trillion versus China’s GDP of $12.2 trillion. In terms of trade, the USA has imported $529 billion on a rolling 12-month basis and China, in stark contrast, has imported $135 billion over the same period. Therefore, there is no doubt that the USA can certainly punch harder because of the levers that it can pull. Trump is relying upon this clout and it is playing out in the latest round of tariffs. On 17th September, Trump announced tariffs on 10% on over $200 billion of products that the USA imports, which come into effect on 24th September and will increase to 25% at a later date. In response, China has said that they are going to impose a tariff on $60 billion dollars of 5% or 10% depending upon the category.

After this round, Trump still has another $267 billion dollars of imported products upon which tariffs can be applied. China has no additional products and can only increase the rates on existing products should it feel the need. Does this mean that America is about to land the knockout punch? Is there any leverage that the Chinese have? From reading the majority of the opinions and newspapers, there is certainly a growing consensus that believes China is backed into the corner.

Float like a butterfly

However, this underestimates China’s ability to box clever and effectively. Ms. Lovely, a professor of economics and trade with China, makes a compelling case that maybe, just maybe, China can outmaneuver Trumps aggression and strength should this fight continue for many more rounds. Her argument centers on the fact that:

a. many factories in China are foreign-owned;

b. China only adds a % of value to the supply chain;

c. China is, critically, thinking strategically.

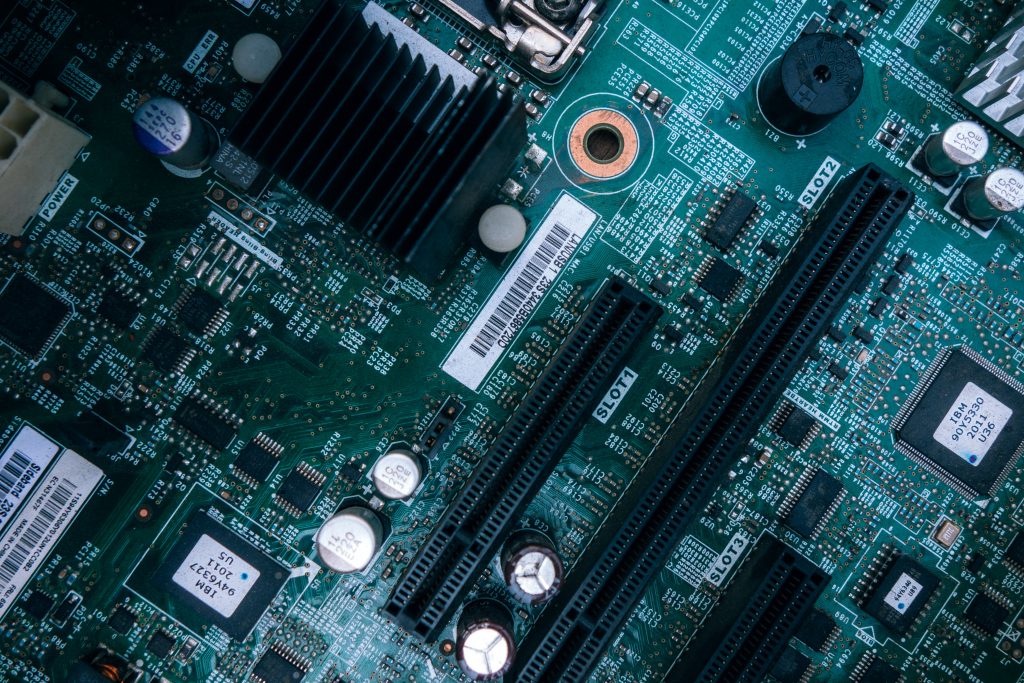

For a start, she points out that 60% of China’s exports to the United States are incredibly produced by foreign-owned factories in China. As a result, there is no short-term solution to the tariffs because it takes many years to close and move factories based upon the structural shift required and the capital expenditure that has already been exhausted to establish the facility in the first place.

Ms. Lovely highlights that in the largest export sector, computers and electronics, China only adds an average of 50% of the value, thereby reducing the nominal impact of the tariffs on China. Different sectors vary in terms of the added value but the argument is sound across many sectors and softens the blow to China (though it raises additional concerns for the global economy because of its interconnected nature).

Finally, China is clearly thinking strategically and is conscious of the context in which this fight is set. China has doubled down on its commitment to its supply chains to the rest of the world and is only putting tariffs in place in response to the United States that are designed to avoid impacting the foreign-owned factories and companies.

In contrast, Trump is isolating the United States and is, based upon the above, impacting U.S. companies with facilities in China and those purchasing from China. Add to that, his rural loyalists are suffering due to the impact in the competitiveness of their exports to China and consumers are already being hit with price increases across the board (e.g. Ms Lovely, points out the 16.7% increase upon washing machines relating to the 20% hike in tariffs that Trump originally imposed).

We would add to the above that should there be a reduction in products imported from China and a material impact upon the Chinese economy, which is a real threat to China because it relies upon the capital inflows, then the RMB is likely to devalue and counter, to some extent, the increase in tariffs to the USA. That said, we do not see the Chinese Government actively devaluing their currency significantly because that would exacerbate outflows of capital and might result in a series of devaluation of currencies by other countries. Li Keqiang confirmed in a speech to the World Economic Forum in Tianjin that, “a one-way depreciation will do more harm than good for China.”

And the Winner is…

We all know that tariffs economically make no sense; they operate as a drag on GDP, are essentially a tax on the consumer and are counter to any free market analysis and, ironically in this case, the republican ideology. Whilst it is accepted not to be a major economic cause by most economists, the Smoot-Hawley legislation enacted by Congress in 1930 was certainly a contributing factor to the Great Depression. As a result of the above, the growing groundswell of lobbyists in Washington DC will continue to increase the pressure upon the administration. With the midterm elections in November, this is an administration that is going to be much more sensitive to these voices than the Chinese Communist Party in its own country.

The problem for all parties with supply chains from or through China is that we have no credible insight into the United States’ strategy. We have an unpredictable fighter in Donald Trump from whom we cannot make real assessment other than running through the various hypotheticals. We really do not know if this is an attempt to push China to address some of the clear violations of its intellectual property practices in the short term or an attempt to reduce the interdependence of the Chinese and American economies over the longer term.

At least over the next couple of years, this lack of certainty will undermine any true structural shift in supply chains from China until people are able to make a better assessment of the underlying strategy and long-term goals.

With an increased understanding of the cost of quality and other production metrics and efficiency, cost is no longer the only metric upon which our clients make strategic sourcing decisions, which is representative of the “Near Far Sourcing” strategy that we see in the market place. We typically do not see clients switch factories without seeing a significant reduction in cost of somewhere between 10% to 15% to outweigh not only production efficiencies, quality but also internal processes and the cost of making changes and developing trust and relationships.

We continue to work with our clients to explore additional opportunities from India, Vietnam and other jurisdictions in which we operate but, we would do the same without the potential of a full-blown trade war playing out because all of our clients are better positioned knowing the sourcing landscape in which they operate. We believe that we need to see more of the fight to determine the outcome and a longer-term strategy for our clients’ supply chain.