Trump has focused on his domestic agenda to the detriment of foreign policy and global trade has suffered as a result.

Uncertainty is never a good thing for business. But it is even worse when it becomes a pervasive feature of our daily lives (like the past 18 months). The Pandemic has wreaked havoc on global business and economies as Governments have lurched from one lockdown to another. But, perhaps just as difficult for business, has been the global Politic and the rise of protectionism that has led to global trade becoming more disjointed, disparate, and more frequently caught in the cross-hairs of world leaders’ political agendas.

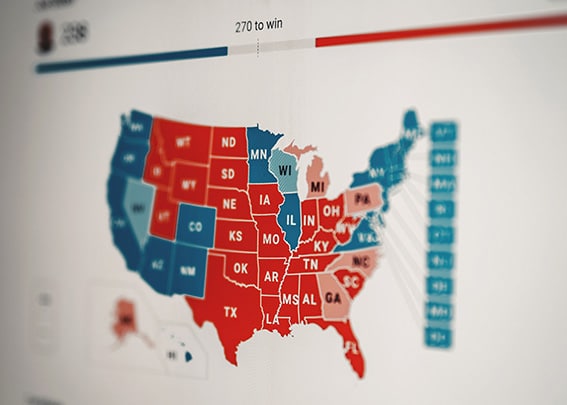

Now we have the US election that has gone down to the wire. At the time of writing, we are still waiting on the final votes from four states to determine the winner.

The outcome is important because it will likely have an impact on global trade. There is an expectation that, under a Biden administration, relations will likely be less fractious. Probably, there will at least be a pathway for alliances across the world stage to be restored. President Trump has focused on his domestic agenda to the detriment of the US’ foreign policy. This election should lay the foundations for greater clarity of policy and to that extent enable US business to make more informed decisions.

The Sourcing Landscape

It is a complex picture. For the past 2 years, US businesses that leverage the benefits of outsourcing manufacturing in Asia have had a sword of Damocles hanging heavy over their heads when manufacturing in Asia. Of course, the main thrust of President Trump’s focus has been the US’ relationship with China. Also, other markets have at different times been pointed to (India and Vietnam for example). Tariffs only reinforced the need for US companies to reassess their sourcing strategies to understand how to diversify their risk or move assets out of China.

What’s next?

However, a lot of US companies with a China-centric supplier base found themselves facing a range of challenges. These point to the latent complexity in a global supply chain that is often neglected as well as the current market conditions (both domestically and overseas). It is worth running through some of these to better understand the path for US Sourcing strategies moving into 2021.

Challenges of Diversification

For many sectors, President Trump forced Asian-US supply chains to look at diversification away from China (pre-Phase 1 tariffs). Some of the issues that currently need to be addressed include:

1. Entering a New Market.

Just as with moving to a new supplier, there is a cost of moving to an alternate market in terms of set-up (molds), learning curve but also potentially understanding a new way of doing business, standards, raw material supply, lead times and cost base. That is not to say that that there are not opportunities, but all these factors need to be considered and managed properly.

2. Alternate Sourcing Strategies.

President Trump has consistently talked about reinstating manufacturing across the US rust belt as part of a ‘reshoring strategy’. He may have been partly successful for large corporations, but from an outsource OEM basis, it is probably a fair assessment to say that most manufacturing sectors have not ‘reshored’ and leveraged the US manufacturing base. Similarly, although there are clear ‘Near Sourcing’ opportunities (Mexico for example), the breadth and capacity of the Asian manufacturing base exceeds any near sourcing opportunity.

3. China’s Supply Base.

Regardless of Tariffs, China is well set up for export with the investment in infrastructure, raw material availability and labour pool. It still, therefore, remains competitive (a lot of the tariff cost was passed back up the supply chain when initially introduced) and with China’s investment in ‘Made in China 2025’ may continue to be relevant for US businesses for the foreseeable future. Of note, the majority of US shoes are still manufactured in China even with the tariffs in force.

4. The Pandemic.

Company survival is the main focus at present with the US economy hindered by the impact of Covid. The appetite for moving to a new market at this time, with the potential costs of moving suppliers/markets, has diminished.

5. Locked Out.

Travel restrictions only compound the difficulty in making significant changes to one’s supply chain at this time. Without the ability to identify new suppliers through trips to Asia, there is a heightened risk of moving suppliers. Again, particularly where the appetite for change now may be diminished.

So what does this all mean?

Of course, US companies should be looking to diversify their supply chains out of any one market. It is more a question of how this is done in this current business environment. An obvious answer is to make sure that you are working with a partner who has reached across Asia and is able to do the ‘on the ground’ work required to access new markets during this period. It is another way of managing the risk and lack of visibility born out of a lack of market access whilst giving you the ability to source and manage suppliers.

That is not to say that China will not still be an important component of any supply chain, and US companies should not adopt a ‘move at all costs’ approach. Chinese manufacturing will broadly still provide opportunities for US companies as well as help embed some resilience in supply chains.

Summary

Whether a Biden administration will change the US stance against China remains to be seen. There is hope that we may at least find ourselves in a business environment that is less uncertain. And that can only be a step in the right direction.

At ET2C, as your sourcing partner, we are constantly looking to provide tangible solutions to our clients. We are already helping our US clients with their sourcing strategies during this period of disruption. Please contact us at contact@et2cint.com for more information how we can help you.