Near Shoring Challenges as Globalised Trade Continues to Grow

The immediate rush and to change Sourcing Strategies, shorten supply routes and ‘Near Shore” is proving much tougher to achieve than anticipated for Sourcing

After the effects of the Global Pandemic, Ukraine War, US-China Trade conflicts and Inflationary pressures to name a few. There was a lot of talk about the need to shorten supply routes and Near or at least friendly shore sourcing.

The background to the rush to Near or Friendly shoring has been the nearly five years of open economic conflict between the US and China. US-China trade flows hit an all-time record of $690.6 billion in 2022. Connecting the countries by a larger movement of trade than any other Nations (without shared borders).

Suggesting that Globalisation is not showing signs of halting. DHL in their recent report suggest that the US-China trade relationship is beginning to show a “general pattern” of decoupling even as globalization more broadly remains resilient, according to DHL’s global connectedness index.

“International flows have proven remarkably resilient through recent crises, and they strongly rebut the notion that globalization has given way to deglobalization,” according to the report, produced with New York University’s Stern School of Business.

“Today’s threats to globalization, nonetheless, are real and demand serious attention,” it continued. “It would be a mistake to infer from the recent resilience of international flows that globalization cannot go into reverse.” What has been the real world experience of brands and companies looking to Near Shore as part of their Sourcing Strategy ?

US Apparel Companies Can’t See a Future Without China

Brands are finding few factories outside the country that can produce the quality and quantity they require.

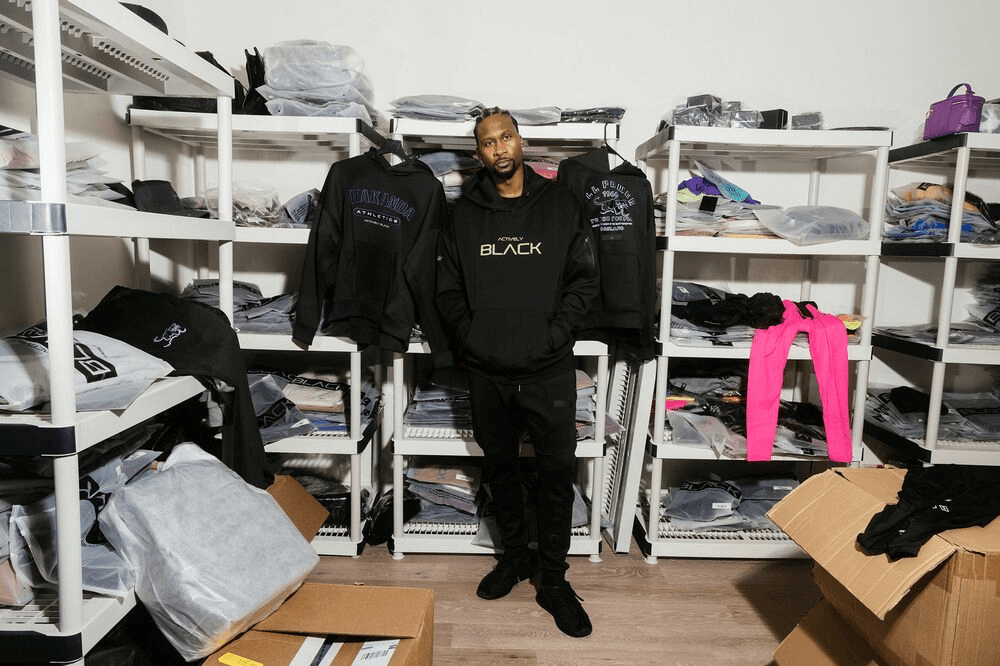

When Lanny Smith founded Actively Black Inc. in 2020, he hired factories in China to produce the brand’s athletic wear. But last year, concerned about production delays caused by China’s Covid lockdowns, Smith explored buying elsewhere. He shipped samples to a supply chain agent who’d assured him there were alternatives in Latin America. “He hit me back the next day and said, ‘You’re not going to find anybody who can do this in the Western Hemisphere,’” says Smith, 38, a former basketball star at the University of Houston.

For many companies buying from China has become more challenging in recent years because of increased tariffs, snarled supply chains, factory shutdowns under Beijing’s Covid Zero policy and rising geopolitical tensions. Factors which have combined to make many Companies and brand owners investigate changing their Sourcing Strategy to be China +1 or to seek to replace China completely. Whilst on the face of it the idea has a lot of merit and upside finding suppliers who can match China for quality and price is not so simple.

Quitting China as a sourcing partner isn’t easy, and most progress has been concentrated in industries such as semiconductors that are considered vital to national security or have high added value. Producers of lower- tech, lower-margin and less added value products such as clothing, shoes, housewares and luggage are finding that few factories outside China have the machinery or the skilled workforce to deliver the quality and specifications required.

Since the 1990s, China has spent hundreds of billions of dollars transforming itself into the world’s premier location for manufacturing. Its factories have the machinery and expertise needed to produce quality products at a volume and pace that’s difficult to match. Along the 80-mile stretch from Shenzhen to Guangzhou, companies can weave, dye, sew, trim, label and package anything from T-shirts to tuxedos. And China’s investment in highways, railroads, air hubs and seaports has created a smooth path from factory gate to consumers worldwide.

Twenty years of Global Trading growth between China and the World is not something that can be dismantled quickly and easily. China’s advantages as a sourcing destination are so great that many companies that have tried to move away have returned at least a portion of their production there. Even moving away from the Chinese mainland cannot guarantee moving away from China. As China has expanded its influence, support for infrastructure and factory investment to other countries such as Ethiopia.

When companies move manufacturing out of China, they often end up working with Chinese- owned suppliers or sourcing components and materials from the country.

Summary

Sourcing strategies are not always quick and easy to implement, the initial idea to relocate manufacturing from China to other Asian or African markets can suggest instant benefits. China’s experience of supplying and shipping products around the World is difficult to replicate. For some markets this may well require more product side compromises to deliver the geographic move.

ET2C Is a global sourcing company with over twenty years’ experience working with our clients to deliver their sourcing strategies. Our offices in seven countries ensure you always have a team on the ground to be your bridge to your Off Shore suppliers.

If you would like to explore Sourcing Strategy options or opportunities within China or in addition to China or to discuss your future challenges.

Please contact us at contact@et2cint.com