Global Trade has already had a challenging 2 years but with further macro-economic shocks, a War on the edges of Europe and Omicron arriving in China, what are the implications?

Overview

Global trade has certainly had a bumpy ride over the past couple of years. Supply chains, particularly out of Asia, are snarled up and this has had a dramatic impact on freight rates, commodity prices and product supply.

The War now in Ukraine – an abhorrent stain on modern humanity – is having a further impact on raw material supplies particularly with Eastern European manufacturing. The interconnected networks of raw material suppliers have been disrupted by suppliers shutting down in Ukraine but also the supply of oil, gas and other raw materials (such as Nickel) out of Russia has now been sanctioned for most Western societies.

Global trade is now staring Covid, War and inflation in the eyes… and it’s not a good place to be.

The War

Aside from the tragic human impact of the invasion, the impact on supply chains is significant. We have spoken over the past couple of years of the need for ‘flex’ and resilience being built into supply chains. The ability to move to other markets and leverage manufacturing hubs that de-couple from China’s vast manufacturing capacity (if that’s possible in certain industries) helps mitigate risk.

A part of this resilience was to leverage ‘near shoring’ as one aspect of a company’s sourcing strategy. Specifically, with regards to European manufacturing (Eastern Europe and Turkey), the war is having a detrimental impact on these markets.

We were at a factory recently, 50 miles north of Izmir on Turkey’s Mediterranean coast that manufactures industrial pressure vessels to be used in agri-business and food processing. The facility was cavernous and had the capability to manufacture these vessels to a high specification. Their immediate issue was that two of their steel suppliers were based in Ukraine and were now ‘off line’.

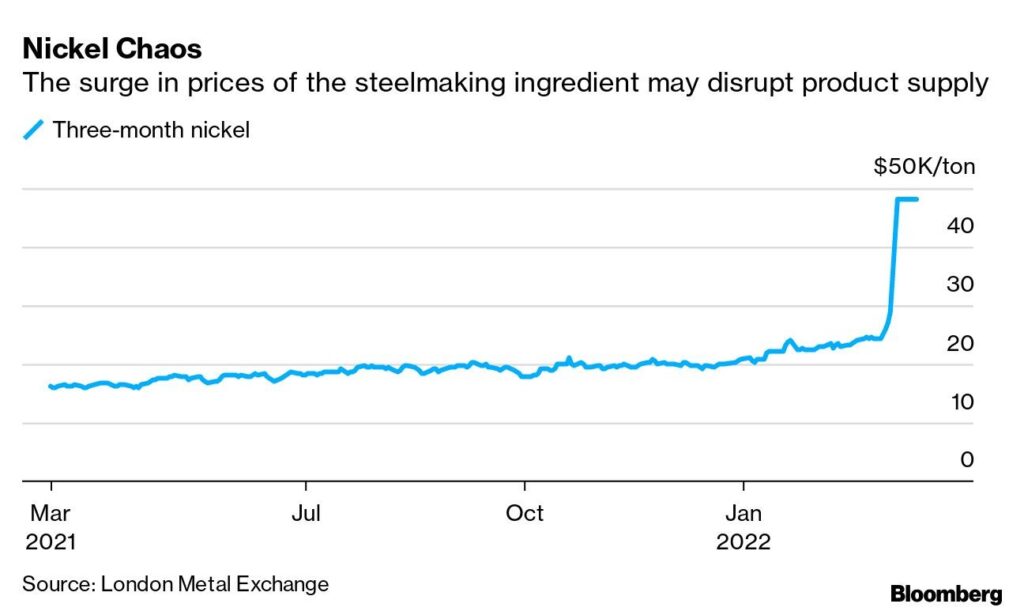

Similarly, Russia is one of the largest exporters of Nickel. A metal that is integral in the manufacture of stainless steel which has a broad application in many products from fridges, surgical instruments, vehicles and cookware.

Commodity prices were already high on the back of constrained supply. The War has just created an additional shock to the supply of raw materials and with higher energy prices, there is a genuine threat to the supply of many products that people use daily.

Covid in China

Two years since the start of the Pandemic, it looks very much like we are moving into a period of disruption within China as Omicron begins to take hold. Whilst Shenzhen is in ‘Lockdown’ and other large cities are also in various states of lockdown and testing, there is inevitably going to be disruption across the Chinese supply base. To what extent, it is difficult to predict but there is concern that with lower vaccine immunity and little or no natural immunity within the population, the risk of a broad spread is a plausible scenario. That said, we do need to take a step back point out the following:

1. The case loads in China are significantly lower than in ‘normalised’ markets such as the UK (China 7 day average 1,627 vs UK 109,624).

2. The Chinese have reacted very quickly and mobilized an army of testers to identify cases and get ahead of the spread.

3. Even at the beginning of the Pandemic, they were quick to implement protocols within factories to mitigate any further spread. It is important to the leadership that China remains open for business on the back of a successful Covid Zero Strategy.

It is currently the case that only limited manufacturing sites have been shut down whilst testing is undertaken. Vietnam managed to maintain some manufacturing sites in the South when HCMC went into an 8-week lockdown. Cities will of course be most vulnerable to outbreaks with higher populations.

The main initial challenge appears to be around transport to the Ports, which remain open. This is especially true where provincial borders need to be crossed. We would anticipate the authorities putting in place protocols to work around this (like drivers not leaving their cabs, PCR tests etc). Remember that Covid protocols have been in place for the past two years where local outbreaks have appeared so there are tried and tested methodologies already in place. The question is whether they can get ahead of the fast-spreading ‘Omicron’ variant.

The Impact

All of this is having an inflationary impact on everything. Further supply constraints have only lit a fire under already high raw material prices. Disruption at Ports will push up freight rates back up to levels that were seen at the end of last year. Global trade is entering an extended period of turmoil, that will require patience to work through. Some key takeouts:

1. The cost of living is increasing in most markets on the back of higher energy pricing, and Producer Price indexes are pointing to higher product prices (if not already in play).

2. Price stability at factories will be very difficult to maintain. Think through how you are negotiating on price and use different levers (terms etc) to make sure you have product supply.

3. Speed to market will be key. Decision making will have to be quick and decisive otherwise companies run the risk of struggling to get production made.

4. PARTNER with your suppliers. The only way that companies will be able to leverage their supply base will be to collaborate with suppliers.

5. China Travel will not open until the Covid Zero policy is dropped. 2023 is now at risk!

Summary

Global trade is in state of turmoil. Partner with stakeholders across your supply chain. Collectively, you will be better than acting alone or with the sole focus of self-interest.

We remain here to help our clients, and get the visibility required to make your supply chain work for you. For more information, please contact us at contact@et2cint.com .

We pray for all those that are currently going through hardship as a result of the War.