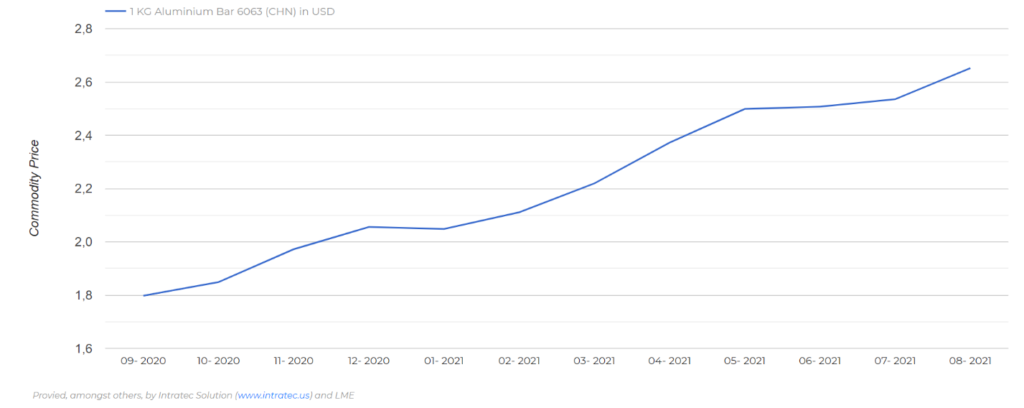

Commodities have recently surged on the back of the devastation the Pandemic has left in its wake. Supply and demand distortions, combined with replenishment of inventories as economies emerge from their Covid ‘hibernations’, have led to an increase in commodity prices.

Overview

Commodities have pushed the Chinese Producer Price Index (PPI) to a 13 year high in August (the PPI is a measure of the average change in the price of goods sold by manufacturers) rising 9.5% from a year earlier, the National Bureau of Statistics (NBS) recently reported. This is the fastest rate of increase since August 2008. It reflects the impact that raw material prices have at the factory gates, and in a sourcing context, the cost implications for overseas buyers. Even with the current freight rates and their impact on ‘landed cost’, this is a further hammer blow to retailers or wholesalers, who are already struggling to get stock for the Christmas season both physically in-store and at the price points needed.

Commodities & China Sourcing

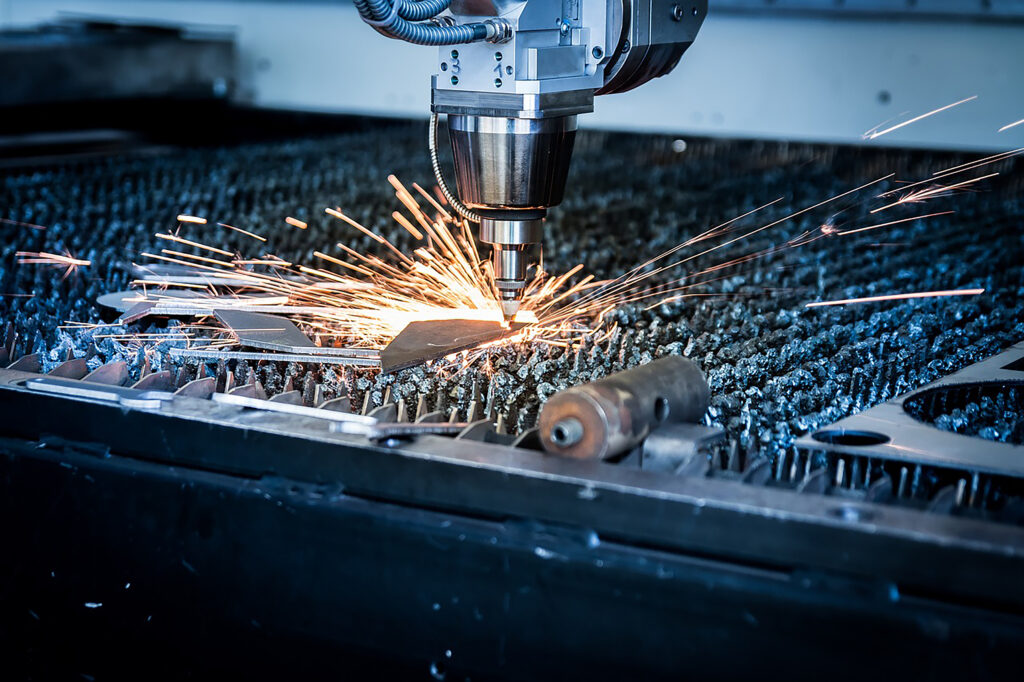

From Metals, coal to plastics and rubbers, there have been price rises across a broad range of commodities over the past 6 months. In some instances, this has forced factories to restrict price validity when providing quotations. Although, not to the same extent as with PPE back in March/April 2020 when there was hyper-inflation due to the extreme demand.

As we all know, factories generally tend to be very quick to point to the ‘ticker’ or graph showing a commodity price trending upwards when negotiating price points. We probably know even more so that the same is not true when commodities start to drop in value, when the factory will point to stock in the warehouse they need to use first.

The fact is that China still counts for over half of the international demand for commodities. It is a behemoth when it comes to consumption and its role in the global commodity market is simply too large and significant to be overlooked. Although the export sector is only one relatively small part of this demand (for example other parts include domestic manufacturing, the construction sector etc.) it gives manufacturers an availability of raw material across a broad spectrum of different products. It is one aspect of the country’s manufacturing DNA that is often overlooked but it is significant relative to other sourcing markets (even with China’s recent Environmental targets impacting certain material production).

One just has to look at South East Asian manufacturing markets, like Vietnam, and certain raw materials will need to be imported from Chinese suppliers. Simply put, it adds cost, lead time and layers of complexity, which plays to the Chinese manufacturing base.

What goes up, must (eventually) come down

It does appear though that there is some softening in the price of metals with the prospect of China’s construction boom slowing and more broadly economic growth decelerating, which will in turn limit demand for these materials. The price of copper and iron order has already started to fall. This may be goods news for some product categories that have already had to absorb some price rises.

Pricing Strategies

When commodities are on the rise, making purchasing decisions is not easy. The basis upon which you make a purchasing decision (the price) can change as quickly as you cut the PO. This is particularly true of the more commoditized products for which the relative percentage cost of the raw material is above 30%. In any business, certainty is beneficial. In such markets, the following ideas should be considered:

1. Raw Material

Make sure you are aware of the raw material fluctuations, not only a global spot price, but also the price in the market you are buying products from. It is important to validate what the factory is saying, and what is driving their prices.

2. Origin

Where is your factory buying its raw materials from? For some smaller markets, it is important to know this so that you can see where potential issues may arrive in the future particularly if they are shipping it in from other countries.

3. Partnerships

We have always pointed to developing true partnerships with suppliers/factories. This will engender much greater visibility of costs and raw material pricing. Also, looking over a medium-term to long term horizon will mean that fluctuations in commodities generally even themselves out. Short-termism and transactional purchases will unlikely provide any benefits.

4. Index the Commodities

When you have longer-term relationships, and you have set out your annual spend, the best way to manage commodity fluctuations is to agree on a base price of the most significant raw material, and then index movements. So, for example, agree on a price of Aluminium and then based on movements both up and down, agree on total FOB pricing that reflects these movements. That way, you have greater certainty, and can make sure that you have sustainable supply going forward. It is the most equitable way of dealing with such price variables.

Summary

We continue to operate in an uncertain market and at the busiest time of the year. Inflation across the supply chain is already driving price increases (see our petition for the UK Government to counter these inflationary pressures). Commodities have been on the increase, but with some challenging headwinds, there may be some let-up and softening of price points into Q4 of 2021.

At ET2C, our solutions are centred around visibility. If you need to know more about raw material price points, and other market data, we are well-positioned to provide our clients with all the relevant information. We are well placed, as your Sourcing Partner, to help you during these difficult times. For more information, please contact us at contact@et2cint.com.