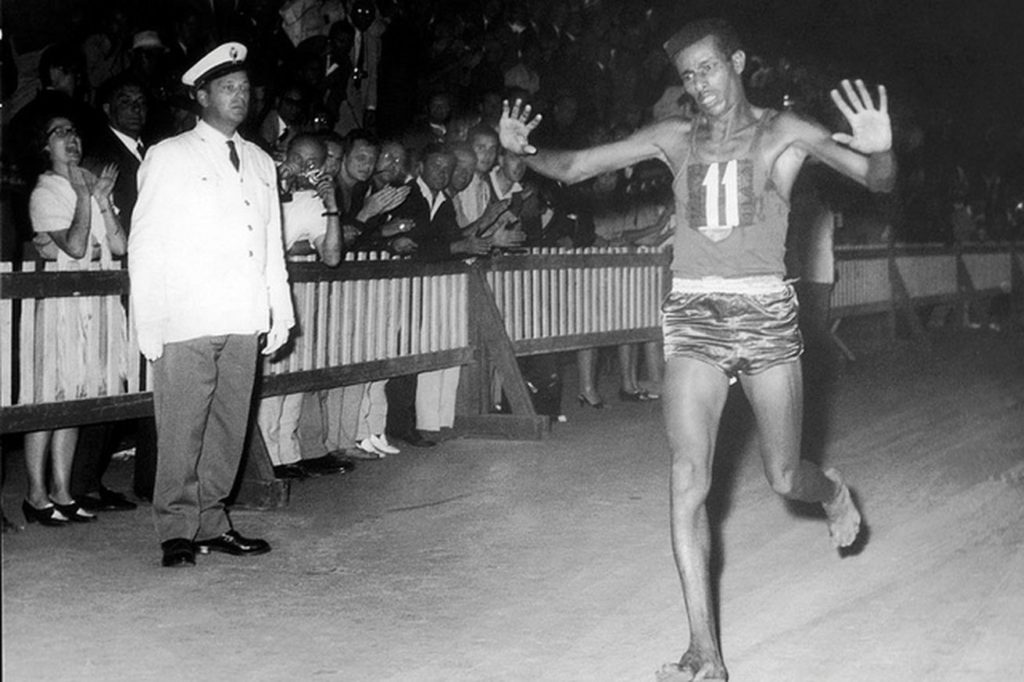

Does the name Abebe Bikila mean anything to you? Unless you’re a running fanatic or Olympics expert, probably not. Abebe was the first African to win the Olympic marathon, which he completed in Rome in 1960. That’s pretty impressive, especially considering that the US and Russia were vigorously training their athletes as a propaganda move, but it gets better. Not only did Abebe win the marathon by running at a 5:10 minute per mile pace (roughly 18.4kph), but he also did it barefoot.

It’s no surprise that his home country of Ethiopia is the oldest independent state in Africa while also boasting the title of the second fastest growing economy in Africa and the world. This fast growth and political stability have flagged the developing nation as a potential site for international businesses to cultivate their business in this possibly-bountiful economic environment.

The global outsource manufacturing sector is increasingly fluid, particularly with soft goods (the lowest value add manufacturing process) and businesses are always keen to identify the latest low cost manufacturing base. Asia’s demographic, even with India included, is aging.

Labor is still an important component of manufacturing even in an era of automation and technological advances. The only other continent that can compete with Asia on labor is Africa.

One of the countries being looked into includes Ethiopia. While all sub-Saharan nations in Africa seem to be experiencing economic growth at an average rate of 3.2%, with its 10% growth as of 2018, Ethiopia stands out as one of the fastest. Can this fast growth be sustained, however? Or is Ethiopia just booming before its bust? A look into the profile of this ancient and resilient nation displays hope for prospective businesses but is not without its red flags.

Ethiopia

One of the characteristics that has caused the most publicity for Ethiopia is the country’s economy. Ethiopia’s exports have all the characteristics of an emerging economy, complete with a dominant agriculture sector with a rapidly growing manufacturing sector. At the time this article was written, Ethiopia exports a total of 3.13 Billion US dollars of products every year, with its main exports being vegetable products like coffee, which constitutes 24% of the total $1.81 billion made from vegetable exports. Manufactured products are still small in comparison, with only 232 million US dollars being coming from this emerging industry. The economy over the past decade has grown at 10% a year making it one of the fastest growing economies in Africa.

Although Ethiopia still ranks as one of the continents poorest countries, it has resource and labor to make it an attractive destination of export manufacturing. With a population of some 100 million people, 70% of whom are under 30, it has a demographic that props up the manufacturing sector, particularly given the unemployment rate is around the 17% mark.

In addition, it has a developing infrastructure, in part thanks to Chinese FDI. Some of the successes in this space include the development of Ethiopia Airlines, upgrading its network of trunk roads, and expanding access to water and sanitation services, all signaling progress for a more connected Ethiopia – the Addis Ababa-Djibouti rail line cut the journey time for taking goods from land locked Ethiopia to the sea from days along roads to 12 hours. However, one of Ethiopia’s largest problems lays in its power access, where, according to a World Bank journal article, a further 8,700 megawatts of power are needed in the next decade, which requires the doubling of the current power capacity (Morella & Foster, 2011).

Nonetheless, Ethiopia is also improving the conditions and sprawl of its road networks, with a US $43m road designing and construction agreement dedicated to infrastructure. Yet, this large investment along with the need to upgrade its power capacity combined with the large trade deficit could see large amounts of debt in Ethiopia’s near future.

Industrial Parks

Similar to the special economic zones that transformed Shenzhen into a manufacturing powerhouse decades ago, Ethiopia now has close to 30 industrial parks demarcated as ‘Special Economic Zones’. There are also incentives for foreign companies to open up manufacturing plants within these zones such as duty free exports, 10 year company tax breaks and no tax for foreign workers and duty free exports.

The majority of these companies are Chinese built and managed but are in the main focused on utilizing the local labor pool contrary to many reports of widespread Chinese labor being imported. Their scale is significant; the Huajin International Light Industrial City is a 1.5 million square-meter park that will eventually have a capacity of 100,000 workers and provide the amenities (such as housing, healthcare etc) – a larger population than the average UK town.

It is not only the Chinese that are investing in ‘Made in Ethiopia’. In Hawassa, some 270km south of Addis Ababa, built at a cost of $250 million by the Chinese Civil Engineering Construction Corporation, there are 140 hectares (part of the first phase) with 52 factory sites which house 20 different apparel firms from 11 different countries. Notably, American clothing giant PVH, whose brands include the likes of Tommy Hilfiger and Calvin Klein, and H&M take up some of the available space.

A Marathon, not a Sprint

That’s not to say that there are not challenges that Ethiopia needs to address. It will take time and it will not happen overnight. Unlike 90% of International Labor Organization member states, Ethiopia has no minimum wage. Even though $57 per month is the international poverty line, there are workers being paid less than $50 per month even with overtime. This is something that needs to be addressed and foreign firms will be giving particular focus to this as part of their ethical code of conducts, and there has also been a ground swell of discontent among workers on pay with an increasing number of strikes being held.

The productivity is currently estimated to be a third of that in China. This will develop over time and is a sign of the immature nature of the manufacturing sector (whereas China has to continue squeezing out any productivity gains to remain competitive) and the development and continued investment that will be required going forward.

Summary

There is a vast demographic dividend on the African continent, and with the Asian average age increasing, the labor pool of the East is beginning to diminish. That is even including countries like India, Bangladesh and Indonesia. Low value add manufacturing is already present within Ethiopian industrial parks, namely footwear and apparel/textiles, and with continued development and investment ‘Made in Ethiopia’ is likely a label that will become increasingly common in Western retail stores. There are challenges, but these are not dissimilar from the Asian manufacturing base some 20 years ago and arguably Western retailers/brands are now better equipped to deal with the management and implementation of ethical standards at overseas manufacturing plants with the visibility now required across their supply chains. It will take time, but Ethiopia is well positioned to be crowned the ‘Winner’ when it comes to mass manufacturing compared with its African neighbors.

Internally, at ET2C, we are making it our business to understand how the Ethiopian manufacturing sector is developing and its current relevance to our clients. We are constantly looking for new opportunities across Asia and beyond to help our clients source from the most suitable suppliers.

Sign up to our newsletter and follow us on social media to keep up to date with the latest developments.