Make in India & PLI Schemes: Building Real Manufacturing Depth or Just Assembly?

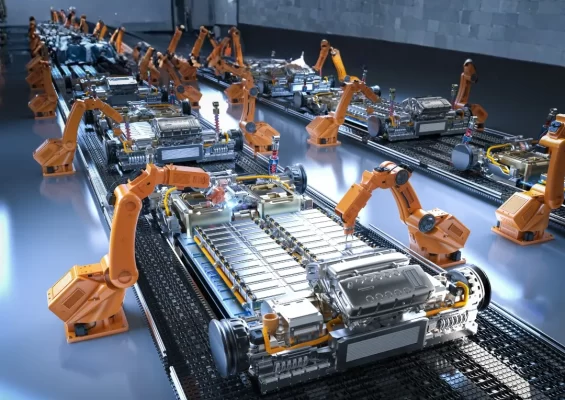

India’s manufacturing landscape is transforming faster than ever. The government’s Make in India initiative, backed by the Production-Linked Incentive (PLI) Schemes, has brought renewed energy to sectors such as electronics, automotive, textiles, and renewable energy.

Factories are expanding, foreign investments are flowing in, and exports are on the rise. Yet, beneath the positive headlines lies an important question that every global sourcing expert is asking:

Is the PLI scheme creating real manufacturing depth, or are we simply witnessing an assembly-driven surge?

At ET2C International, we’ve worked across India, China, Vietnam and Turkey for over 25 years, helping brands build agile and sustainable sourcing networks. Watching India’s manufacturing ecosystem evolve from the inside gives us a clear view of where the country is winning and where it still needs to go deeper.

India’s PLI schemes: Understanding

The Production Linked Incentive India’s PLI schemes is one of India’s most ambitious industrial programs. Instead of offering generic tax breaks, it directly rewards manufacturers for increasing production and domestic sales.

The initiative spans 14 major sectors, including mobile phones and semiconductors, automotive components, pharmaceuticals, and solar modules. Its goal is to make India not just a low-cost destination but a globally competitive manufacturing hub.

With an overall investment outlay nearing ₹2 lakh crore, the scheme aims to boost exports, reduce import dependence, and create millions of jobs. Invest India – Manufacturing Renaissance through PLI Schemes

Make in India : The Positive Momentum So Far

There’s no doubt that the PLI schemes have already started reshaping India’s industrial story.

- Surge in Investment and Employment

According to government data, over ₹1.76 lakh crore in investments have been made under PLI, leading to the creation of nearly 12 lakh new jobs.(Economic Times Report) Electronics manufacturing has seen the strongest gains. India has become one of the top smartphone exporters in the world. - Global Brands Are Expanding in India

Companies like Apple, Samsung, Foxconn, and Dixon Technologies have expanded operations under the PLI umbrella. These moves signal strong global confidence in India’s production capabilities and long-term potential as part of diversified supply chains. - Growth Beyond Metros

The manufacturing boom isn’t confined to large cities. Industrial clusters in Sriperumbudur, Noida, Hosur, and Tirupati are witnessing rapid development, driving local employment and infrastructure upgrades. - Export Growth Across Sectors

Exports in electronics, EV components, and machinery have all risen sharply. For the first time in decades, India is being recognised not just as a consumption market but as a manufacturing contributor to global trade.

Make in India : The Core Debate: Depth vs Assembly

For all the good news, one friction point remains at the heart of every conversation: Are we truly manufacturing in India, or are we assembling imported parts within Indian borders?

Dependence on Imported Components

While mobile and electronics exports are climbing, a large percentage of key components, chips, lenses, modules, and circuits are still imported from China, Vietnam, or South Korea. In telecom, local value addition remains as low as 5%, despite heavy incentives.

(Economic Times – Telecom PLI Fails to Increase Local Addition)

Make in India: Uneven Sector Progress

Some industries are scaling faster than others. Electronics and pharmaceuticals have gained strong traction, while solar module and battery manufacturers are struggling to hit production targets. Reuters reports that almost two-thirds of solar companies approved under PLI may fall short of their targets by 2027. (Reuters – India’s Manufacturing Incentives Progress)

Foreign Dominance in Performance

Many of the biggest success stories are led by foreign firms. Domestic manufacturers often face challenges in scaling technology, automation, and quality to compete globally. Without strong local supplier development, the risk remains that India could remain a high-volume assembler rather than a deep manufacturing ecosystem.

Skill and Infrastructure Gaps

True industrial depth requires more than just incentives; it necessitates world-class logistics, a consistent power supply, precision tooling, skilled labour, and robust R&D facilities. While these areas are improving, progress remains uneven across different regions.

Why Manufacturing Depth Matters

- Economic Resilience

When India builds its own supply-chain networks, it reduces dependence on imports and becomes more resilient to global disruptions, a lesson the world learned during the pandemic. - Sustainable Competitiveness

Assembly-driven growth may boost GDP in the short term, but long-term competitiveness depends on innovation, engineering excellence, and homegrown component manufacturing. - Global Sourcing Confidence

For international buyers and brands, “Made in India” carries greater weight when it reflects true value creation, not just assembly. Local value addition translates into more reliability, better control, and shorter lead times.

At ET2C, we frequently encounter this topic in our discussions with clients. Many global brands are eager to source products from India, but they often ask, “Can India handle the entire production process, or can it only assemble components?” This question highlights the extent to which India is integrated into global supply chains.

India’s PLI schemes :The Path Forward What India Must Focus On

Encouraging Component Manufacturing

PLI should now evolve to reward companies that invest in upstream components such as semiconductors, PCBs, auto parts, and raw materials. Building these at home will increase domestic value addition and create long-term competitiveness.

Strengthening Supplier Networks

Large OEMs and global manufacturers should actively partner with tier-2 and tier-3 Indian suppliers — providing technical training and helping them achieve global quality standards. This collaboration can speed up localisation at every level of the supply chain.

Investing in People and Innovation

Skilled labour and innovation are the lifeblood of manufacturing depth. India must scale up technical education, vocational programs, and R&D incentives to ensure that its workforce can support high-precision, high-volume production.

Building Infrastructure That Matches Global Standards

From logistics to industrial parks and renewable energy reliability, India’s physical and digital infrastructure must keep pace with its production ambitions. A smooth, efficient backend will drive faster output and better exports.

ET2C’s Perspective on India’s Manufacturing Shift

From our on-ground operations in India and other sourcing markets across Asia, we see a clear transformation taking place.

Global companies are increasingly looking to India for electronics, automotive parts, apparel, and engineering goods. PLI schemes have improved production visibility and investment appetite. However, depth and consistency remain works in progress.

At ET2C International, we help global businesses navigate this evolving landscape, connecting them with fully audited, validated, and scalable Indian suppliers who meet international standards of quality, compliance, sustainability, and ethics.

We support brands with:

- Margin growth

- Innovation delivery

- Supplier search and validation

- Quality control and compliance management

- Production supervision and logistics coordination

- Sustainable and transparent sourcing

To learn more, visit our India Sourcing Solutions or explore ET2C’s Global Supply Chain Services.

Make in India:Delivering Sourcing Success in India

India’s Make in India and Production-Linked Incentive (PLI) schemes have established a strong foundation for industrial growth. Investment is flowing in, exports are increasing, and global players are gaining confidence in the country’s potential.

However, the next phase of progress will depend on how deeply India can engage in manufacturing, rather than simply assembling products. True success will come when India manufactures not only finished goods but also the components, materials, and technologies that underlie them. It will be achieved when domestic suppliers innovate, research and development thrives, and value creation permeates every layer of production.

At ET2C, we believe this transition is already underway. As India evolves from being merely an “assembly hub” to an “innovation hub,” it will redefine its role in global supply chains not just as a low-cost producer, but as a reliable, high-quality manufacturing partner for the world.

To start a deeper discussion about delivering the decisive role of Indian sourcing and Global Supply Chain Services in your organisation, drop us a line contact@et2cint.com

Anishi Gupta

Position: Digital Marketing Specialist

Anishi Gupta is a Digital Marketing Specialist focused on performance marketing, content strategy, and data-driven growth at ET2C LinkedIn or anishi.g@et2c.com.