Freight rates have soared towards the end of 2020, in a year when you would anticipate low demand and low rates.

Freight rates form an integral component of any sourcing decision. They are part of the ‘landed cost’ which can determine the cost-effectiveness of where your products are being purchased from. This combined with minimum order quantities, lead times, shipping duration and any import tariffs (or anti-dumping duties – something which we have seen a fair bit of throughout the Trump Presidency) will determine additional costs on top of FOB prices.

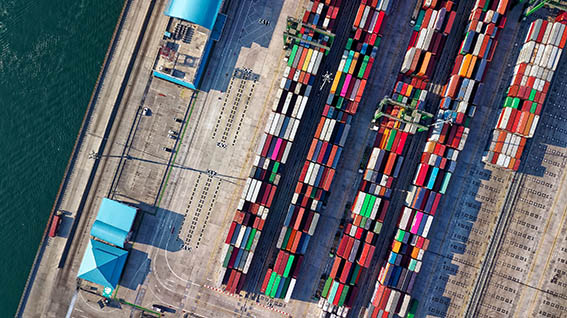

It was back in 1956, when the maiden voyage of Mclean’s Ideal X ship signaled the beginnings of an era of globalisation. Trucker, Malcolm Mclean, had become frustrated with the slow and inefficient loading times. His vessel, the Ideal X, had a fitting system that improved the security and loading times. This led to the invention of the simple shipping container – which is now commonplace across the world’s ports (and sometimes the seas). Certainly, it changed the global economy and transformed global supply chains. In fact, it provides an easy and cheap way to transport goods around the world. By 1973, container ships were carrying approximately 4 million TEUs (Twenty ft Equivalent Units) annually. By 2013, nearly 90% of global trade was seabourne with 700 million TEUs shipping each year. That number has continued to grow with the expansion of consumerism to today.

The market is now largely commoditized against a backdrop of complex international supply chains demanding frequent quick and efficient movement of goods. Freight rates are currently surging towards the end of 2020. There appears to be little respite going into the new year, with rates expected to continue on this trajectory. Given 2020 has largely been a year of lockdowns and economies being put on hold, what is driving this market rise?

Freight Rates during the Pandemic

The Freightos Baltic Global Container Index (FBX), which is a weighted average of 12 major global container has risen to $2,635 per forty-foot equivalent (FEU) container as at the 4th December (the highest on record).

If you look at the indices for specific routes though, you can see that China/East Asia to the US is over $3,800 per FEU and China/East Asia to Europe is just under $3,000 per FEU. Of course, these are only spot rates and when you add on surcharges and other costs, the actual cost to the US on a ‘off contract’ rate is over $5,000. This trend will continue into Q1 of next year (there are whispers of $10,000 per FEU come CNY for China to Europe for off contract rates!) and perhaps only start to ameliorate towards Spring/Summer 2021, although some of the carriers are cautious given the unpredictability of the global demand during this Pandemic.

So, what is happening here? Back in February/March, when China went into lockdown, the ocean carriers successfully mitigated the impact of the supply chain disruption by implementing a ‘blanking strategy’ which withdrew approximately 30% of sailings from Asia to the US and Europe. As the virus spread into a Pandemic, and demand dropped away, the carriers continued to hold back capacity. Demand out of Asia is now back (China’s exports are up 11.4% year on year) and with the capacity lag, it is driving up freight rates due to simple supply/demand economics. This demand is driven in part by PPE, but also certain product sectors have recovered (furniture, homewares, etc).

Although there is an element of the carriers – in their alliances – now controlling prices to their advantage, the main issue is the time it takes to bring back capacity. And this is not just related to the actual ships. The equipment required to move containers from factories through to the ports. This is currently more of an issue for forty-foot containers, which is causing high surcharges and ‘pinch points’ and delays with bookings.

Freight Rate Tips

Although we are not a freight forwarding company, we do have our own logistics team. This department works with our clients on bookings, shipments, and anything in between. Here are some of our current tips:

1. Book Early

Where possible, order early and book the space early. As much as possible building in ‘flex’ into your supply chain will always present better, likely more cost-effective, options.

2. 20Ft over 40Ft

We are seeing better capacity on the 20 ft boxes. Also, we are advising our clients where possible to split shipments to get the capacity. In some cases, it is actually cheaper once the surcharges are taken into account.

3. Trains, Planes & Automobiles

Always make sure that your freight forwarder is giving you the best and full range of options. Trains out of Chengdu, China, take 12 days to get back to the UK. This may be a viable alternative given some of the other rates currently in the market.

4. Annual rates

For companies doing volumes out of Asia, contract rates will assure fixed prices for the duration of the year. Lock these in where possible.

5. ‘Near Sourcing’

It may be that there are options to adopt a near sourcing strategy as part of your overall sourcing strategy. This means leveraging suppliers closer to your market to counter the increase in freight costs, and ultimately landed cost.

Summary

It has been an extraordinary year in so many ways. Among other things, it has taught us that agility is an important characteristic of any company. Planning and being able to make decisions early, will always help. Freight rates may be rising, but with some planning and foresight, it will be possible to address the next challenge 2020 throws at us.

At ET2C, we are well placed to help manage your Asia Sourcing across multiple markets with teams on the ground as well as work with our clients on their shipping needs. For more information, please contact us at contact@et2cint.com.