Global supply chains have been the subject of many articles, column inches and broadcast journalists’ notes over the past year, and with good reason. As we start 2022, is this disruption coming to an end – we look at five key trends for the year ahead.

Overview

Global supply chains have been significantly disrupted throughout 2021 primarily due to imbalances in supply and demand. The media spotlight has emphasised how supply chains nowadays are interwoven webs that span out across borders and oceans. Globalisation and efficiencies within the shipping industry (containerisation) have enabled supply chains to scale creating significant benefits for consumers.

As companies look to build resiliency and ‘flex’ into their supply chains in 2022– potentially identifying new suppliers in new markets – the level of sophistication is likely to increase, albeit there should be a greater capability to address the disruptions this past year has presented.

For any company, the situation caused by the global pandemic has revealed weak points but also opportunities. Having a good understanding of the current scenario and identifying the factors that will impact the global supply chain in 2022 will present a strategic advantage for any business aiming to build greater resiliency.

Global Supply Chains: What to Expect in 2022

1. Logistics Capability

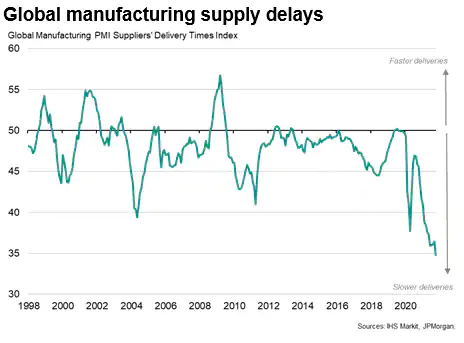

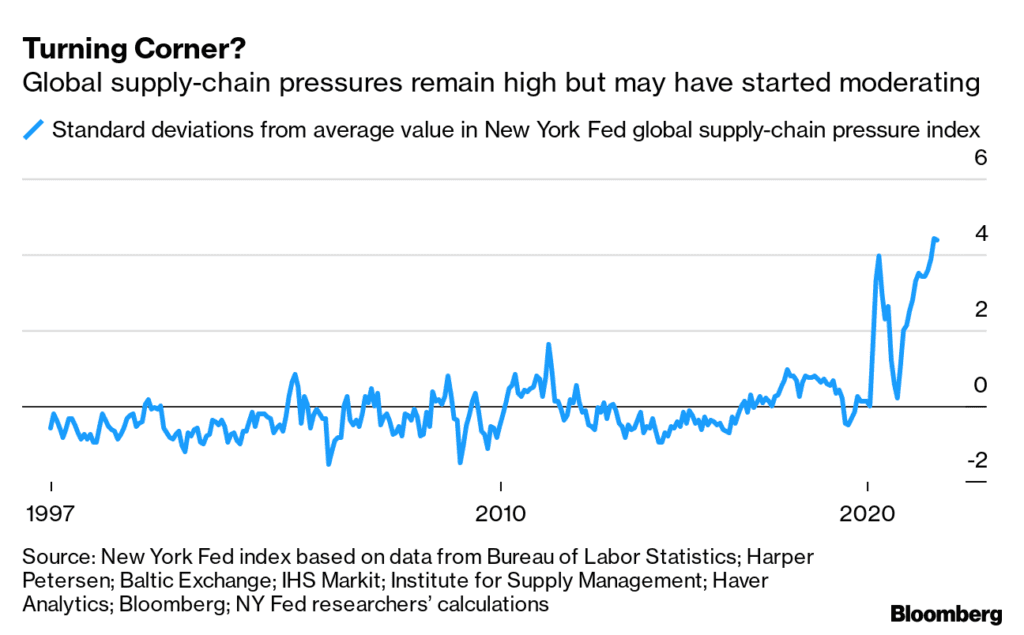

With the factory shutdown in China back in February/March 2020, there has been a myriad of factors that have created disruption to logistics capability including repeated market global lockdowns (Hong Kong has just taken measures in its 5th wave), bottlenecks on supply routes, container shortages and consequential factors like freight rates and delivery times.

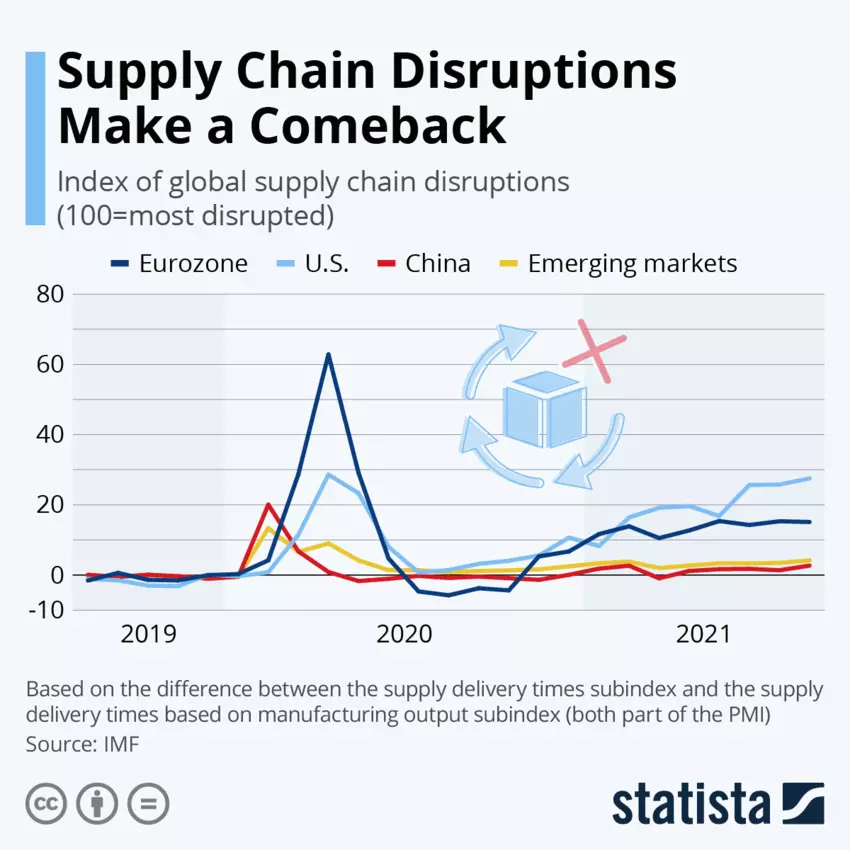

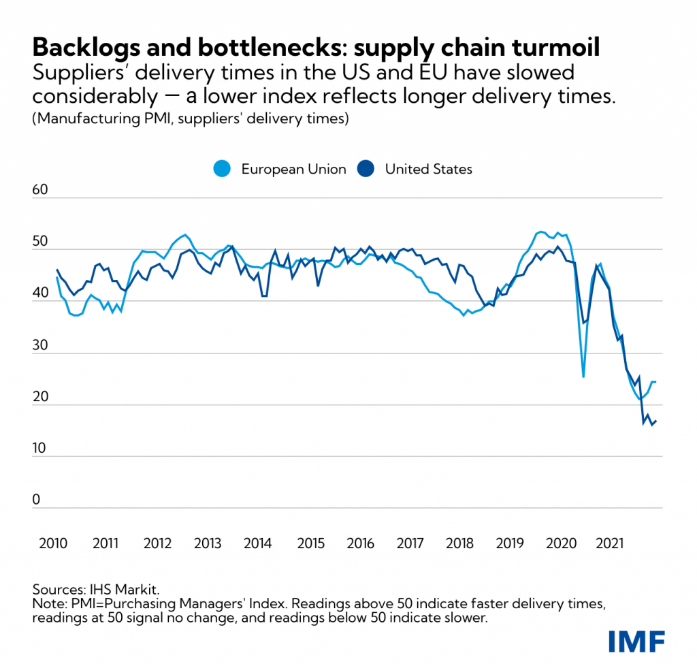

The recent sharp drop in the delivery times index reflects surging demand and/or widespread supply constraints. In such situations, as buyers need to closely manage stock levels, it is usual for suppliers to have greater negotiating power. Also, and importantly, such delays can have a significant impact on working capital availability potentially constraining cashflows.

Many reports forecast that container capacity will continue to be constrained over the coming months which will lead to a shortage of imported products. However, there is an expectation that the situation will ameliorate into Q2 after the usually Chinese New Year rush – notwithstanding a lot of companies have already ‘stocked up’ to address the lead times. Anyway, assuming that these disruptions recede and that access to sea and airfreight reverts back to pre-pandemic levels, it will likely take some time before the market normalizes.

To build resiliency, companies should look to re-design alternative supply chain flows and focus on strategic sourcing.

2. Production Lead Times

Production lead times have already been pushed out in 2021. Certainly, in China, there has been disruption caused by an electricity shortage on the back of some lofty environmental commitments. A bull market in commodity prices has left some suppliers struggling to access the necessary raw materials on time. And this is all overlaid by the disruption in logistics that will inevitably push out delivery times should raw materials need to be moved both in the market or externally.

According to Deloitte, some industries (like semiconductors/chips) will continue to face shortages next year (Supply of raw material not meeting current demand of strategic materials) although this should be less severe than the past 12 months in particular.

3. Doubling down on Technology Investment

The pandemic, by ‘pressure testing’ global supply chains, has helped highlight weaknesses. One of these is certainly the lack of visibility, as there are many stakeholders and participants within the extended network. To overcome this issue, companies will increase their investment in technology to enhance critical supply chain planning capabilities by adopting more advanced digital enablers. In particular, they will invest more into advanced technologies – such as cognitive planning and AI-driven predictive analytics – to significantly improve visibility and consequentially become more responsive to major disruptions.

4. Commodities

The global economic recovery, accommodative monetary policies, bad weather, structural shifts in the energy sector and supply chain disruptions have propelled commodity prices higher to make commodities the top-performing asset class in markets this year. In particular, in 2021, some commodity prices rose to or exceeded levels not seen since the heights of 2011. For example, natural gas and coal prices have reached record highs.

In addition, the events of this year have highlighted how changing weather patterns due to climate change are a growing risk to energy markets, affecting both demand and supply.

In 2022, commodity prices are likely to stabilize and potentially soften on the back weakening demand. The market still has the potential for more supply and demand elasticity fueled by rapid technological advances and demographic shifts.

This transparency will need to also cover the pricing and costing. Organizations will likely increase spending on analytics tools and software packages to increase the visibility across bills of materials and the respective price drivers. This will drive greater supplier consolidation and ESG segmentation, helping in reducing the variation in quality and pricing for the same type of product/service across geographies.

5. Workforce and labor

The multiple disruptions caused by the pandemic have significantly affected also the employment sector, facing uncertainties and severe labor market shortages, which have further complicated the post-COVID-19 recovery scenario for many industries. The Omicron variant continues to create challenges in markets when it comes to workforces and access to additional labour. Movement across borders is severely impacted particularly in Asia. And with the Lunar New Year approaching, there is uncertainty about labour availability should workers be able to travel home; will they be able to then return?

Summary

Global supply chains are changing and evolving at a faster pace than pre-Pandemic. This is partly driven by necessity but also the times have accelerated plans and spending that were waiting on the sidelines. Modern operations are increasingly focused on technology and innovation and this will help companies manage increasingly complex supply chains. Disruptions, although to start ameliorating, will undoubtedly continue into 2022. This time, though, it is fair to say that companies are better prepared and with the right capabilities in place, will manage appropriately.

At ET2C, we are already working with our clients across multiple markets as their partner of choice and are well placed to help manage more complex supply chains. With a team on the ground, we make sure we provide the visibility required to our clients. For more information, please contact us at contact@et2cint.com.