Containers are the lifeblood of Global Trade and the Pandemic has perfectly illustrated how important they really are. Now with Omicron still raging across multiple markets, what is the latest on global trade flows?

Overview

Containers are commonplace wherever you travel. Whether loaded up at a Port, on the back of a lorry on the motorway or sitting on a train carriage, they are an ever-present symbol of trade and the movement of goods. Introduced back in 1956, containers were a transformative catalyst for trade to become truly global by enabling cheap and easy ways to ship goods around the world.

The Pandemic disrupted the movement of containers around the world, which is much more a delicate dance that ebbs and flows with the seasons. Suddenly in April 2020, containers were not readily available where they usually are and there was a complete mismatch between supply and demand. For example, thousands of containers were being stored in warehouses by the UK Government filled with PPE, when usually they would be on their way back to the Far East in all likelihood.

The result has been an incredibly challenging year in 2021. Container prices on certain high demand routes went up by 6 times as demand for space far outstripped capacity. This was compounded with bottlenecks at Ports, labour issues, equipment shortages and carriers introducing blank sailings to re-jig container availability (or profiteer in some instances).

Containers – A Traumatized Sector

According to a recent survey conducted by Container xChange, the container industry is rethinking its strategy. In particular, 70% of respondents said that they have plans to diversify sourcing options and resort to holding more inventory. This is certainly the case, although there is still a broad resilience within Chinese supply chains that appears to have negated some of this migration out of China.

There is a further expectation that the industry is still downbeat about supply chain performance in 2022; 65% of respondents said that performance will either deteriorate further (11%) or remain the same (54%) in the year ahead. But this is also justifiable, the scars of 2021 are still very raw.

The container gridlock has definitely traumatized this industry and continues to do so. This has not been helped by shippers using boxes as storage, container line failures, inefficiencies in matching box owners to potential users, and longer transit times and port congestion that has made container rotation slower.

Ports in LA are still struggling to clear the backlog of container ships waiting off the Coast, although there are positive noises being made about this ameliorating into Q2 of this year.

Outlook for 2022

It is clear that the shipping bottlenecks have exposed one of the most serious threats to the global economy as it emerges from the pandemic: whether the worldwide traffic jam remains gridlocked or begins to flow again in 2022. If the bottlenecks persist, freight costs will remain high, space for cargo on ships will be limited and retailers and manufacturers will have to endure chronic delays. That could in turn fuel sustained inflation, prompt supply chain upheavals and accelerate the consolidation of shipping networks, fundamentally changing world trade.

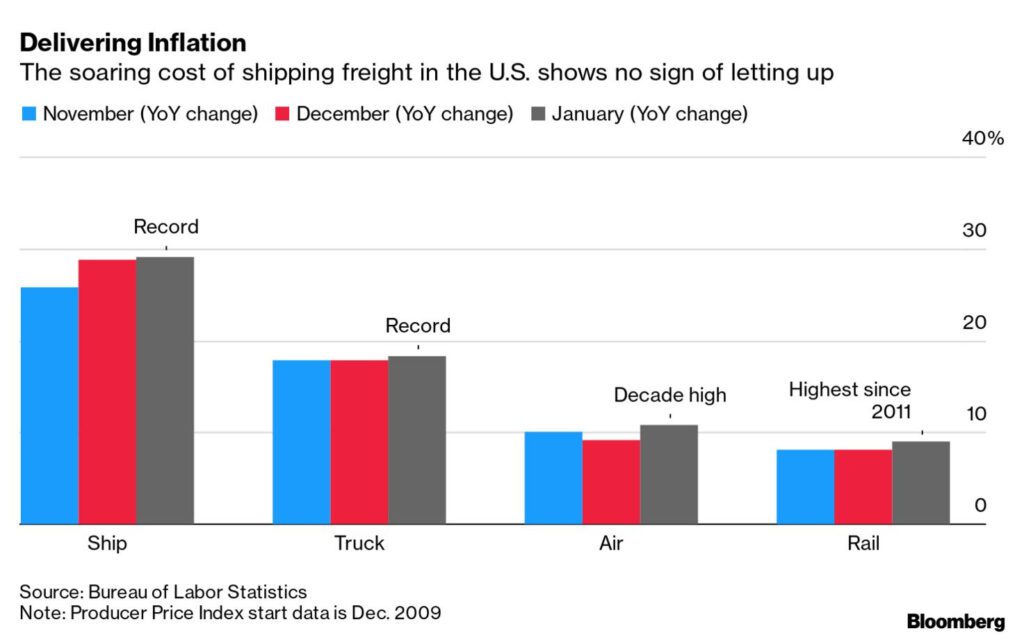

The cost of shipping freight, as an example, into the US shows little sign of abating. It is true that there has been some softening of freight rates, but these may not be so much to do with supply constraints easing, but demand dropping around Chinese New Year (and higher stock inventories prior to the end of 2021). Across all modes of transport, record highs have been recorded based on year-on-year comparisons.

Looking across these different modes of transport, Bloomberg reports that there has been an 18.3% jump in shipping by truck and a 29% rise in Ocean Freight rates.

Delivering Inflation

More and more Central Banks are having to review comments made in 2021 that inflation was only going to be temporary. The reality is that inflation is now being imported in containers (freight rates and higher commodity prices would be built into the product landed cost) and if this has not yet hit the retail shelves, it is shortly about to only compound monetary policy decisions.

Blackrock,

the investment house, has recently pointed to a ‘new and unusual market regime, underpinned by a new macro landscape where inflation is shaped by supply constraints.’ They suggest that this was perhaps overlooked by the Mandarins setting looking at the cause of inflationary drivers. These have been predominately a result of supply constraints all along global supply chains. Whilst demand was high in certain sectors, production is always constrained by the weakest link in the supply chain.

To take the example of the Fashion industry, supply chains will continue to face disruption as a result of logistical bottlenecks, material shortages and rising costs, according to The State of Fashion 2022 report by The Business of Fashion and McKinsey & Co. There remain significant challenges around product and resource shortages as chocked supply chains and rising shipping costs undermine operations. Over recent months, numerous companies reported difficulties in managing inventory flows or have tied lower sales forecasts to supply-chain blockages. Inevitably, in response, many have turned to remedies that include more nearshoring, in-store supply stocking, and agile operating models designed to respond flexibly to change.

Summary

It is by no means a simple picture. The challenges of 2021 will persist, and supply led inflationary pressures will push up prices along the supply chain. The tentacles of sourcing operations around the world will adjust their reach to counter some of these difficulties but such decisions will need to be married with other important business decisions around sustainability, which will likewise drive strategy in 2022.

Trade will continue to flow. Containers will continue crossing oceans and landscapes. The question is whether the blockages of 2021 can be addressed (or more supply of containers delivered) to get Global Trade back on its feet.

At ET2C, we are already working with our clients across multiple markets as their partner of choice and are well placed to help manage more complex supply chains. With a team on the ground, we make sure we provide the visibility required to our clients. For more information, please contact us at contact@et2cint.com.